WhatsApp is stepping up security for iPhone users with the introduction of passkeys.

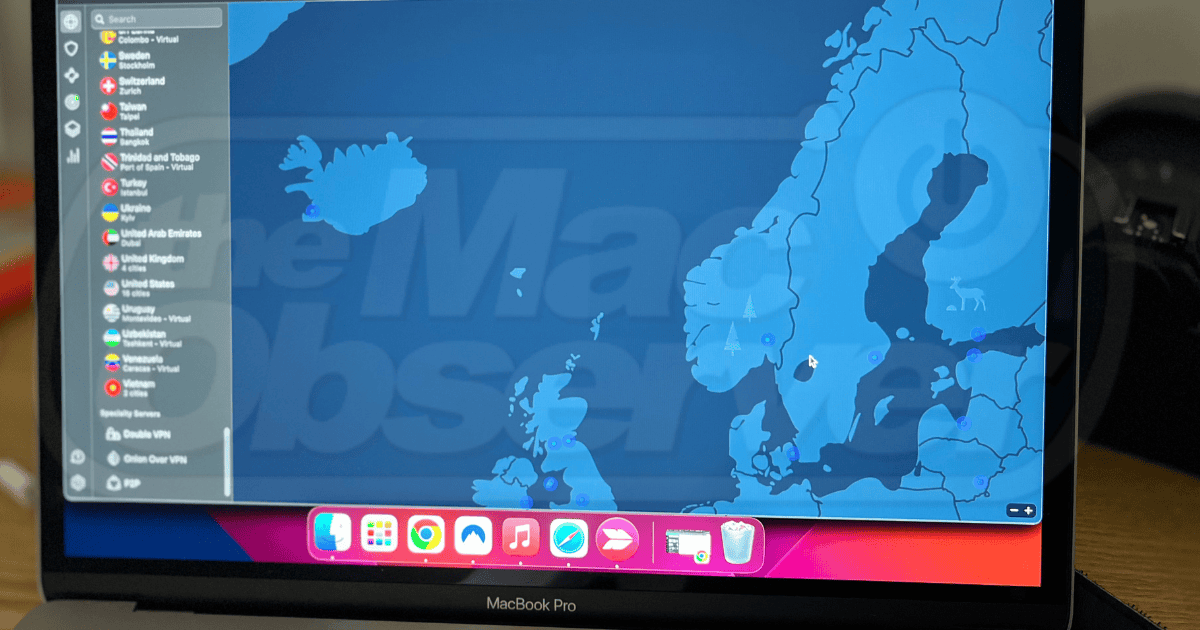

NordVPN for Mac Review: Is It Safe To Use?

Learn all about NordVPN for macOS in this comprehensive, tried-and-tested review. Discover its key security features, pricing, and more.

iPhone Activation Market Share Dips To Lowest in Six Years, per Report

iPhone’s activation market share has dipped to the lowest in the last six years in the U.S., which is a concerning sign, according to CIRP.

Apple AirTag Helps California Man Recover His Stolen BMW

An Apple AirTag coupled with a dash cam became a lifesaver for a California couple, as it helped them track down the thief who stole their BMW.

Google Chrome for iOS to Restrict Parcel Tracking Feature to U.S. Users

Once available worldwide, Google’s new in-chrome package tracking for iPhones is now limited to the US. Frustrated? We explain why this feature might be restricted and what it means for international users.

Telegram CEO Takes Shot at Apple, Claims Download Numbers Unaffected After China Ban

Telegram CEO criticizes Apple’s app store restrictions following China removal. He claims downloads remain unaffected and blames Apple’s “walled garden” for potential user shift to Android.

Apple Rolls Out visionOS 1.2 Beta 3 to Developers

Apple has rolled out the third beta update of the upcoming visionOS 1.2 to developers, following the second beta update released last week.

Apple Releases Third Betas of iOS 17.5, iPadOS 17.5 and macOS Sonoma 14.5

Apple has rolled out the third beta updates for upcoming iOS 17.5, iPadOS 17.5 and macOS Sonoma 14.5 to developers.

iPad Could Finally Get the Much Needed Calculator App with iPadOS 18

While you can always turn to the App Store for alternatives, the lack of an official option seems a compromise for many.

Apple Adds 8 Suppliers in China; Why? 50% India-Made iPhones “Not Good Enough”

Apple is adding more suppliers in China despite efforts to diversify its supply chain. India is emerging as a new player but faces challenges with high defect rates.

Apple Announces Special Event for May 7 To Unveil New iPads

Apple has teased a special event called “Let Loose” for May 7. It’s an online event and will begin at 7 AM PT on World Athletics Day.

Apple's FineWoven Accessories Might Continue to Live On

Recently it was rumored that Apple will pull the plugs on FineWoven accessory. Now Apple is rumored to launch new color of FineWoven accessories.

After Losing the Top Spot Internationally, iPhone Sales Drop by 1/5th in China, Worst Since COVID

Apple iPhone sales in China saw a steep decline of 19% in Q1 2024, their worst performance since the pandemic. Huawei’s resurgence and US-China tensions are cited as contributing factors.

Ray-Ban Meta Glasses Finally Feature Full Apple Music Integration

This new integration will allow Apple Music subscribers to seamlessly enjoy their favorite music through their Ray-Ban Meta glasses.

Emulation on iOS: What to Know About Retro Gaming on iPhone

Apple now allows for emulators on the App Store: here’s all you need to know about classic gaming and emulation on iOS.

Ecosia Launches a Cross-Platform Browser on Earth Day

Ecosia has released a new cross-platform browser that produces green energy and is three times faster than the majority of standard browsers.

Ukraine Asks Apple To Withdraw Gambling Apps From the App Store

Ukraine’s President bans gambling in military ranks due to concerns over morale amid conflict with Russia. President Zelenskiy asks Apple to remove gambling apps from App Store.

iPhone 16 to Feature Capacitive Buttons With Haptic Feedback

A new report suggests Apple will launch the iPhone 16 with new haptic feedback buttons instead of mechanical ones.

Apple Watch Users With WatchOS 10 Reportedly Facing Extreme Battery Life and Draining Issues

Some Apple Watch users on watchOS 10 report decreased battery life. Learn about potential causes, troubleshooting tips, and how to get the most out of your Apple Watch battery.

Customers Are Losing Interest in Apple Vision Pro Ahead of International Launch

Rumors suggest Apple plans to launch the Vision Pro in different countries before WWDC, but customers are losing interest on the headset.

Google Chrome's Quick Delete Feature Will Soon Be Available on iOS

Google Chrome seems to be working on “quick delete” feature for iOS users, after announcing the feature on Android devices a while back.

Accessory Maker is Already Selling Cases for the Much Rumored 12.9" iPad Air

Some accessory makers are already ahead of the game, offering cases for the upcoming 12.9-inch iPad Air which is yet to be released.

Apple Halts Production of FineWoven Accessories Amid Criticism Over Poor Durability

A leaker claims Apple is stopping FineWoven accessories production ahead of iPhone 16 launch due to concerns by users about its durability.

Apple To Skip M3 Mac mini to Launch M4 Version

Apple will skip the M3 Mac mini and launch the M4 Mac mini by the end of 2024 according to a leak by Bloomberg analyst Mark Gurman.