Apple’s iOS 17.5 Beta 2 update introduces the ability for users in the EU to sideload apps directly from a developer’s website.

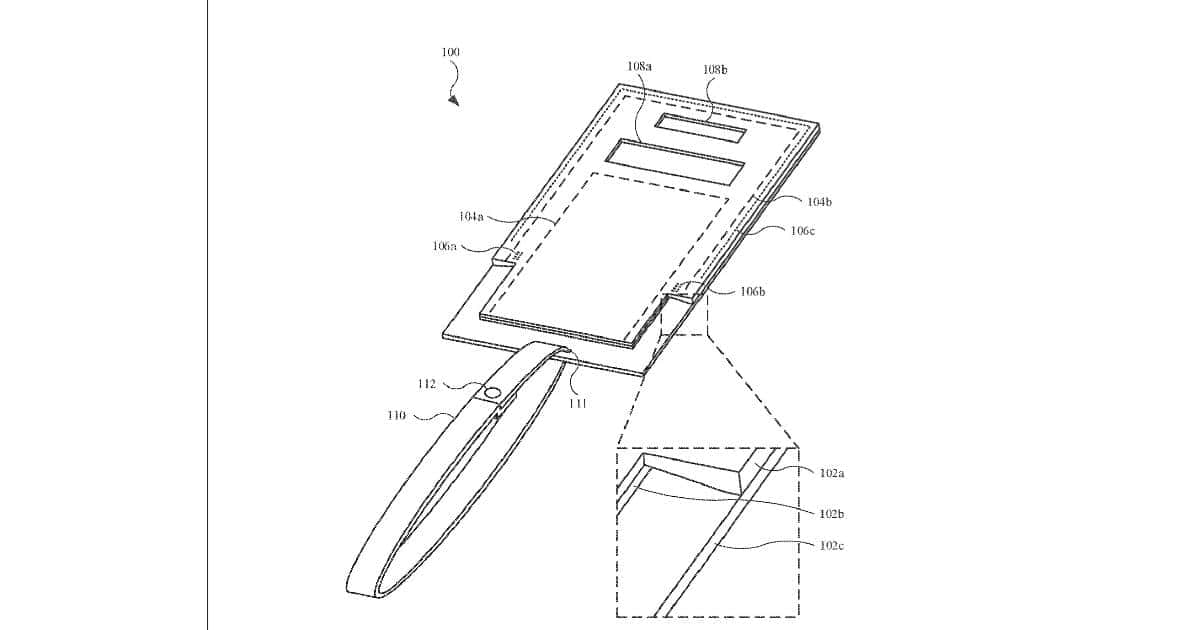

Apple Patent Hints at Future Wearables With Health Monitoring Capabilities, Apple Watch Who?

An Apple patent filing reveals technology for future wearables that could monitor biometric data and location to deliver real-time health advice and potentially lifesaving aid. This describes a system that tracks health data and overlays suggestions within a mixed-reality system, potentially designed for continuous wear.

Apple Highlights Trade-Ins and Recycling Your Devices for Free in Pre-Earth Day Initiative

Apple has placed a banner on its website ahead of Earth Day on April 22nd, reminding users that can recycle old Apple devices for free.

Future Apple Watch Might Throw a Lifeline with Drowning Alerts, Hints Patent

Apple may be planning to add a feature to future Apple Watches that could help prevent drowning, according to a recent patent.

Apple Experimenting With a Magsafe Wallet and iPhone Case Hybrid

Apple is potentially expanding the MagSafe lineup with a new patent hinting at a case integrating a wallet and lanyard.

Lossless Music Coming to Spotify With New “Music Pro” Subscription

Recent rumors suggest Spotify will finally launch a lossless music tier after years of delays and wait from fans and users.

Tech Giants Like Apple Can Now Face Fines Upto 20% for Anti-Competitive Tech Practices in Japan

Japan proposes significant increases in antitrust fines for tech companies engaging in anti-competitive practices, potentially reaching 20% of sales. The revisions target restrictions on app market access, mirroring a global trend towards regulating Big Tech.

iPhone 15 5G Performance Is Slower Than Samsung Galaxy 24 Across the Globe

A report reveals Samsung Galaxy S24 series has a faster median 5G performance than the iPhone 15 series in most of the tested countries.

It Was Fun While It Lasted; Apple Gets Dethroned in Smartphone Market, Sales Down by 10%

Apple’s iPhone shipments fell in Q1 2024 despite a global smartphone market rise. Samsung regains the top spot. Learn why Apple faces challenges and what investors are watching at WWDC.

iPhone 16 Pro To Solve One of Apple’s Biggest Flaws

The new iPhone 16 Pro camera system would solve one of the most common and frustrating problems in Apple’s history.

Apple Found To Be Disabling Apple Watch's Blood Oxygen Sensor When Given for Repairing

Are you an Apple Watch user concerned about the blood oxygen sensor? Reports say Apple might be disabling the sensor on some repairs, even for older models. Here’s what we know about the situation and potential reasons behind it.

The App Store Allowed an iPhone Game Boy Emulator for the First Time. Now It’s Gone

For a few days, users were able to download a Game Boy emulator through the Apple Store. However, Apple has now deleted it.

Once Again, Apple Advocates for 8GB of RAM being Enough for MacBooks

The recent releases, including M3-powered MacBook Air and Pro, have stayed true to tradition, kicking off with 8GB RAM as par for the course.

Chrome Tests Feature To Address Unusable Passwords After macOS Password Resets

Chrome is testing a new feature to resolve an issue where saved passwords become inaccessible after resetting a macOS password. This feature would automatically remove undecryptable passwords, ensuring the Password Manager functions properly across all Chrome platforms (Windows, Mac, Linux, Android, and Chrome OS).

Twitch Revealed New Features for Mods on iOS as It Celebrated Mod Appreciation Day

In celebration of Mod Appreciation Day, Twitch announces new features to empower moderators! Learn about Mod View on mobile, anonymous warnings, and upcoming Creator Camp resources.

How to Register/Unregister in Apple Beta Software Program

Eager to check out beta software updates on your Apple devices? Check out this guide on how register for the Apple Beta Software Program.

Apple’s First AI Features Will Happen on Device

Apple’s AI features in iOS 18 will happen on device and won’t rely on external servers, according to recent leaks

M4 Mac Roadmap Leaked: Here’s What We Know about Apple’s Next Big Thing

Here’s the entire roadmap Apple has planned for its brand new M4 chip and its variations. The first Mac with the M4 will ship in late 2024.

Apple Keyboard Has a Weird Emoji Suggestion Problem

Apple emoji keyboard is reinforcing weird stereotypes and suggestions when people are looking for different geographic regions or countries.

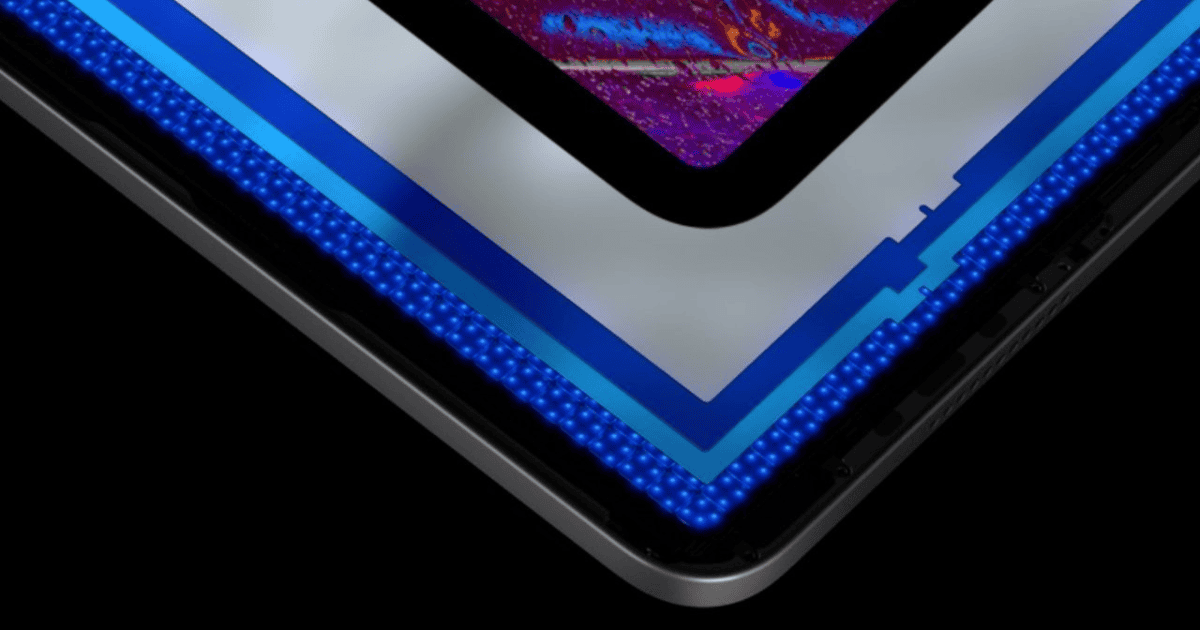

iOS 17.5 Beta 1 Reveals More Details About Upcoming iPad Pro

The OLED iPad Pro and all its details have leaked in Apple’s iOS 17.5 beta 1. According to analysts and leakers, t’s launching in early May.

iPhone SE 4: Four Features You Should Expect

The iPhone SE 4 is launching in 2025, and here are the four features you need to know about before Apple unveils it.

iPhone 16 Pro to Launch in 4 Beautiful New Colors

Apple plans 4 new colors for its flagship iPhone 16 Pro and iPhone 16 Pro Max: Space Black, White, Rose, and Grey.

Top Analysts Believe iPhone 17 Could Be a Better Upgrade, Instead of iPhone 16

Some analysts already believe that iPhone 16 might not perform well, because the major leap is expected with the iPhone 17 series instead.

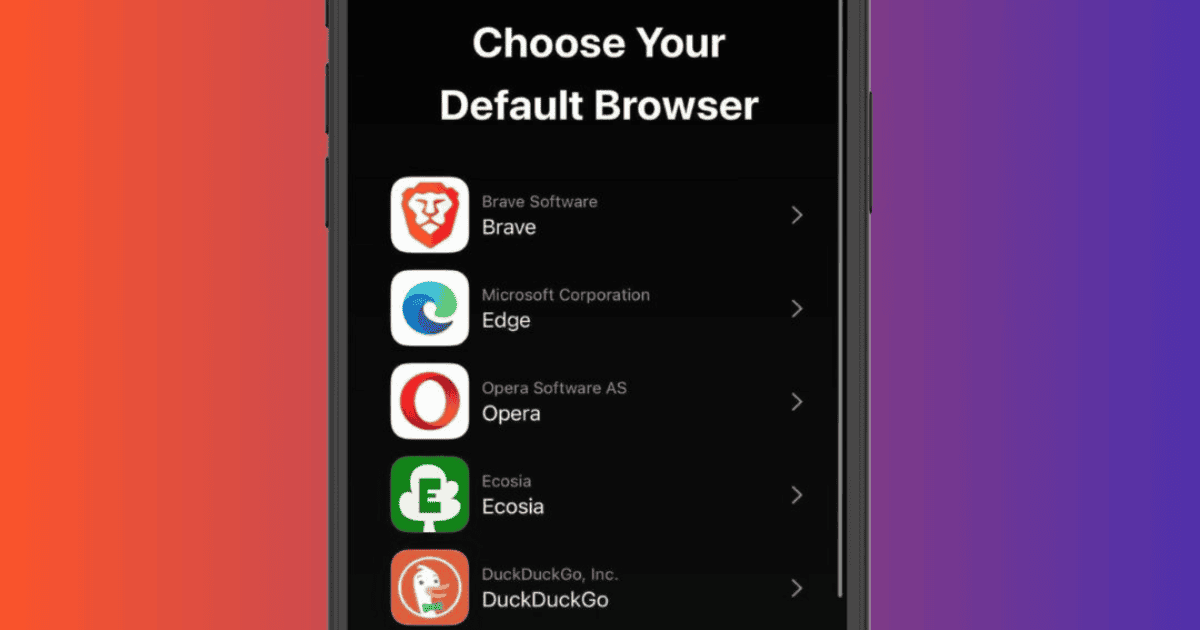

Opera on iOS Sets an Example of How Much Has DMA Affected the Competition, Reports 63% Growth

Opera for iOS sees a surge in European users (63% growth) following the implementation of the Digital Markets Act (DMA). The DMA allows users to choose their default browser, potentially leading to a more competitive mobile browser market in Europe.