The upcoming 12.9-inch iPad Air, scheduled to launch alongside the 2024 iPad Pro in the second week of May, could feature a mini-LED display, according to a new report.

A New App Signals at Apple Vision Pro’s Imminent Launch in China

A 3D shopping app specifically made for the headset by a major retailer suggests that the Apple Vision Pro will soon be available in China.

Apple Cut a Deal to Scrap Usable iPhones That Later Found New Homes in Asia

Many of these iPhones still function well and could be cleaned up and sold. Yet, Apple paid GEEP to destroy more than 250,000 every year.

Refurbished Apple Watch Ultra 2 Units Are Now Available in China

Apple is selling refurbished Apple Watch Ultra 2 units directly to customers in China and could start shipping them to other countries.

3 Key Benefits of Using iPhone’s Night Shift Mode

Does Night Shift on your iPhone offer any real benefits? Here are three reasons why you should enable this feature in low-light settings.

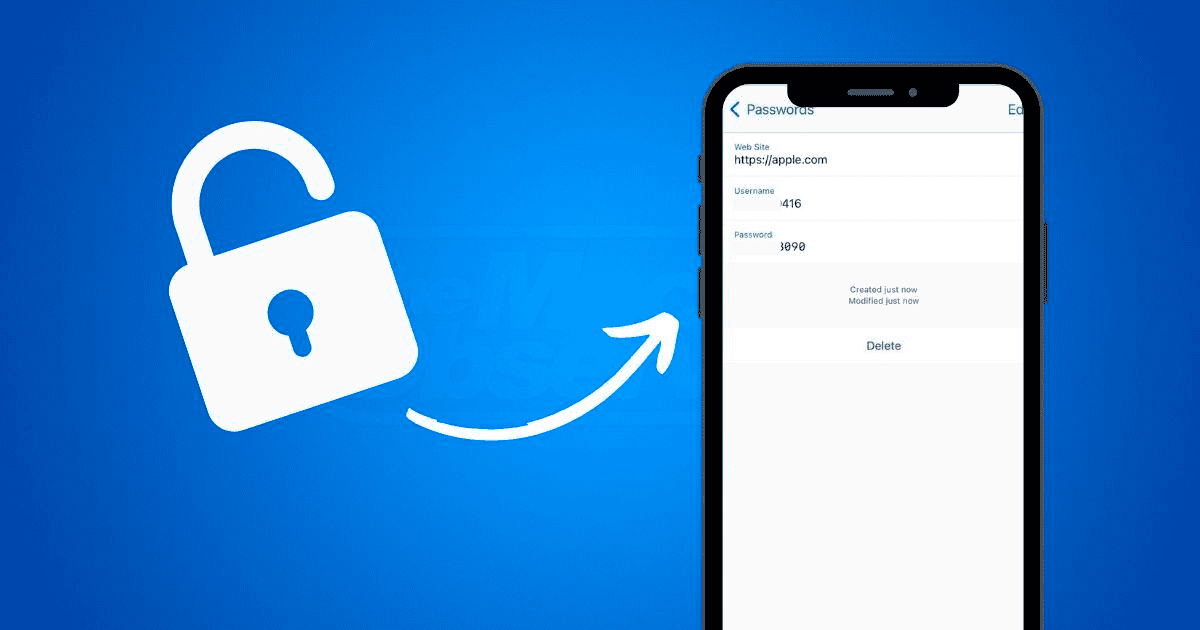

2 Ways To Find Your Apple ID Password Without Resetting It

Forgot your Apple ID password? In this guide I will share 2 methods to retrieve your password without the hassle of resetting

How To Install tvOS 17.5 Developer Beta 2

Looking to test out the new features of tvOS 17.5 Developer Beta 2? Check out this short guide on how to download and install on your Apple TV.

5 Questions You Should Never Ask Siri: Avoid These at All Costs

While Siri can be an essential part of an iPhone or Apple Watch experience, here is a list of things that you should never ask this personal assistant.

iPhone 17 Plus Screen Size Might Be Smaller Than Current Plus Variant, Says Report

Well, would you settle for an iPhone that’s lacking that Plus factor?

iPhone Enjoys About Double the Popularity of the Mac Among Apple Users, reveals Study

A report reveals how deeply Apple customers are invested in ecosystem, claiming over 90% customers have an iPhone nearly double the Mac’s.

You Can Now Download the Delta Emulator From the App Store

You can now play a wide range of retro games on your iOS device with Riley Testut’s Delta emulator, available directly from the App Store.

Apple Plans To Manufacture Camera Modules in India but Not Their Phones With 3 Cameras

As Apple looks to diversify iPhone production away from China, they’re seeking camera module suppliers in India. Talks with Murugappa Group and Tata’s Titan Company could create a more localized supply chain.

WhatsApp Introduces Chat Filters To Help Declutter Your Messages

Chat filters for WhatsApp are here to effortlessly sort chats, find messages fast and ditch the endless scroll.

WhatsApp Is Working on a Feature To Pin Channels for iPhone

WhatsApp is working on a new pin channels feature for iOS to let users pin their preferred channels at the top of the list.

Report: China Might Be the Culprit Behind Recent Apple Spyware Attacks

A report suggests LightSpy, a piece of spyware with Chinese connections, was responsible for the most recent attack on Apple iPhones.

iOS 18 Set To Bring Major Boosts to Apple Notes

iOS 18 is expected to bring a ton of new features to Apple Notes, such as integrated audio recording and support for mathematical notations.

Apple Stops Suggesting Palestine Flag for 'Jerusalem' Searches, Ending Controversy

iOS 17.5 beta 2 doesn’t suggest Palestine flag now when you type Jerusalem after updating your device, putting an end to controversy.

Editorial mistakes & covering rumors at The Mac Observer

We acknowledge and apologize for this mistake. This source’s opinions were made public in one of our articles (now retracted) without thorough verification from our editors. All parties involved in this process are no longer part of our team.

How To Install visionOS 1.2 Developer Beta 2

Looking for ways to install the new visionOS 1.2 Developer Beta 2? This guide has everything you need to know.

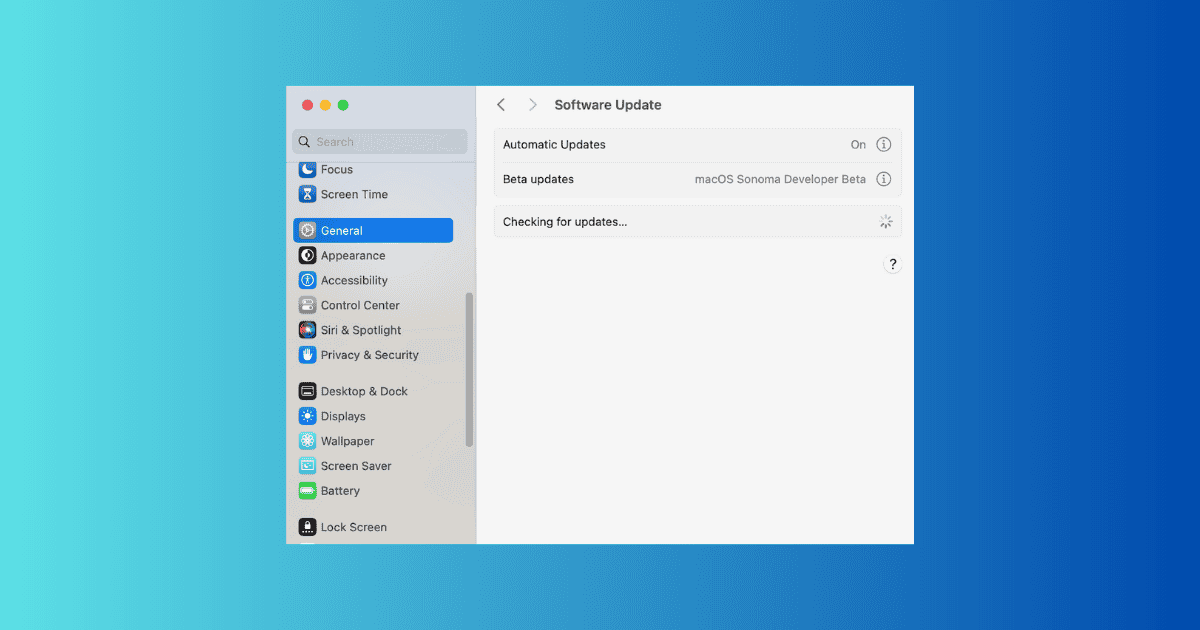

How To Install macOS Sonoma 14.5 Developer Beta 2

The new macOS Sonoma 14.5 Developer Beta is here. Check out this quick guide to find out more and install the version.

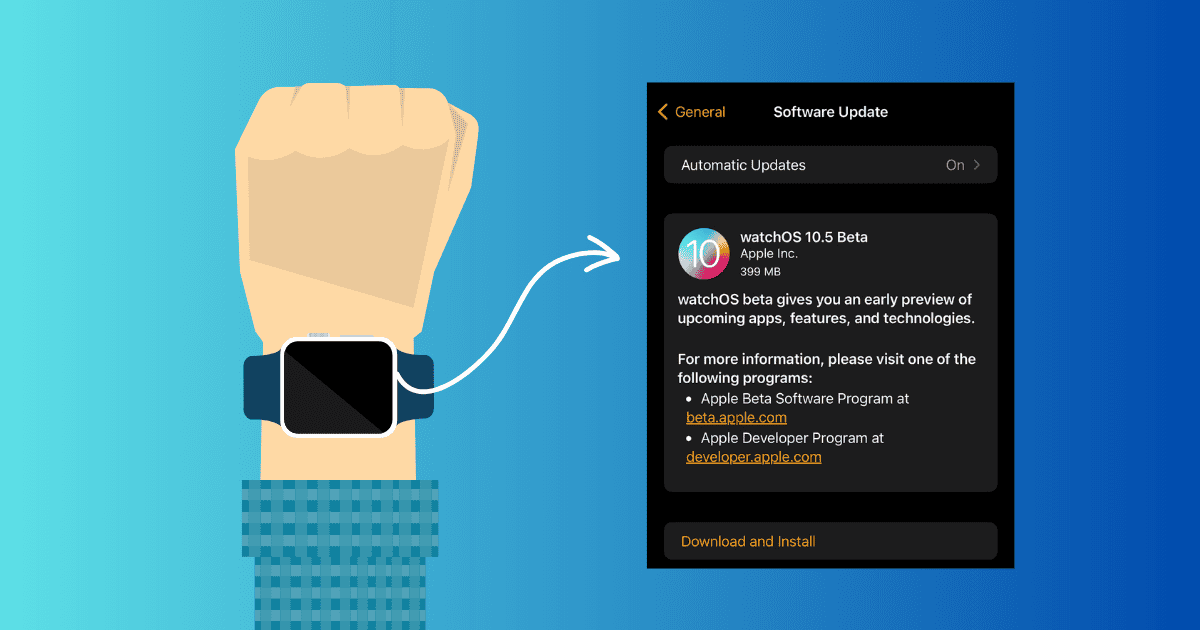

How To Install watchOS 10.5 Developer Beta 2

Looking to install the watchOS 10.5 Developer Beta 2? Check out all the steps and a quick guide to know more.

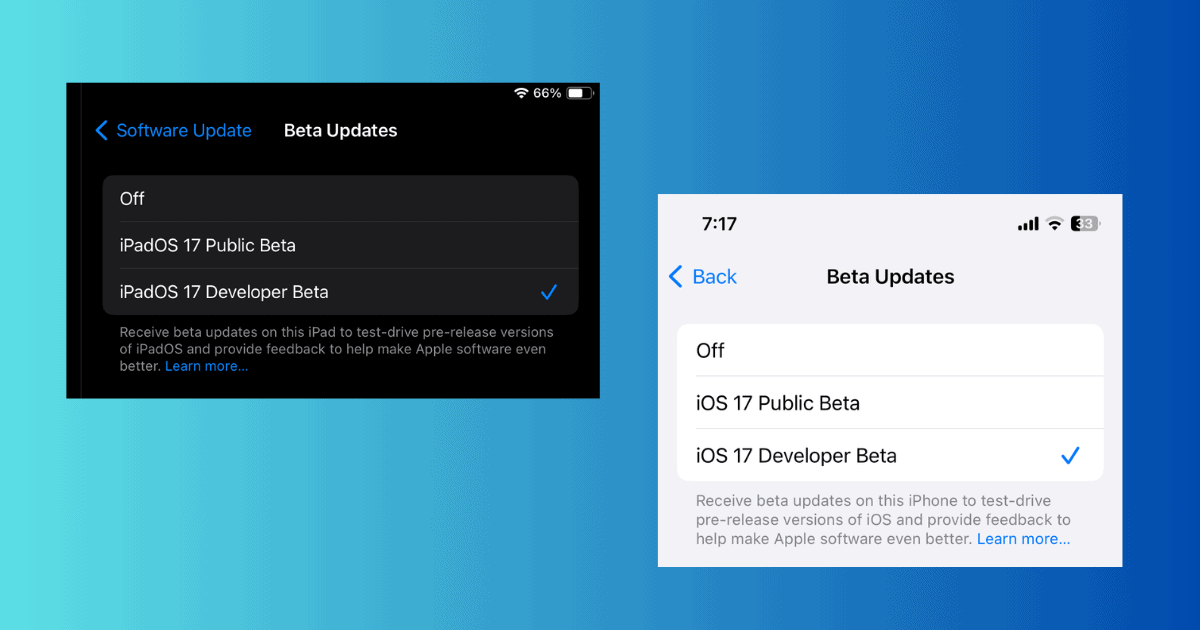

How To Install iOS 17.5 & iPadOS 17.5 Developer Beta 2

Are you trying to install the iOS 17.5 & iPadOS 17.5 Developer Beta 2 on your devices? You’re in the right place!

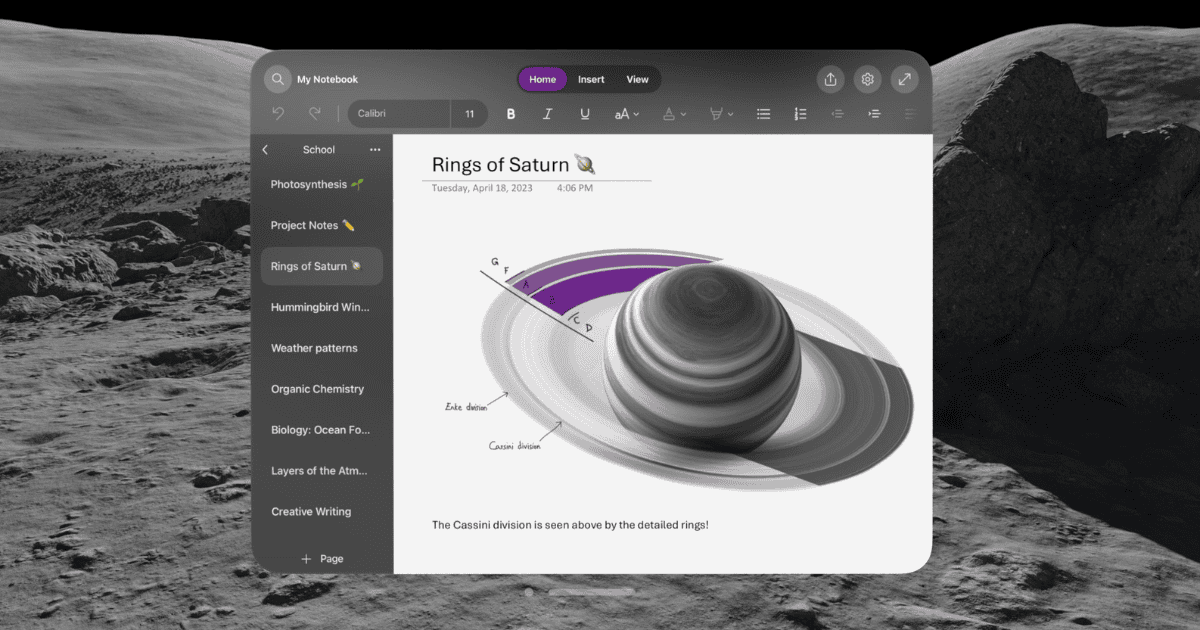

Microsoft's Note-Taking App 'OneNote' Now Available on Apple Vision Pro

Microsoft OneNote lands on Apple Vision Pro! Take notes, build digital notebooks, and manage tasks directly in mixed reality. This new app offers familiar OneNote features like organization tools, cloud storage, and collaboration. Learn more about functionality, installation, and supported accounts for Apple’s latest MR headset.

iOS 17.5 Beta 2 Introduces App Downloads From Websites for EU Users

Apple’s iOS 17.5 Beta 2 update introduces the ability for users in the EU to sideload apps directly from a developer’s website.