Finding Out If You’re Affected

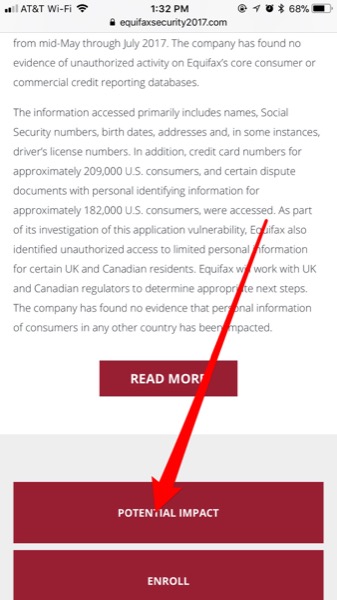

If you wish to proceed, here’s what the process looks like. First, visit equifaxsecurity2017.com. Just scroll down, and click or tap on “Potential Impact.”

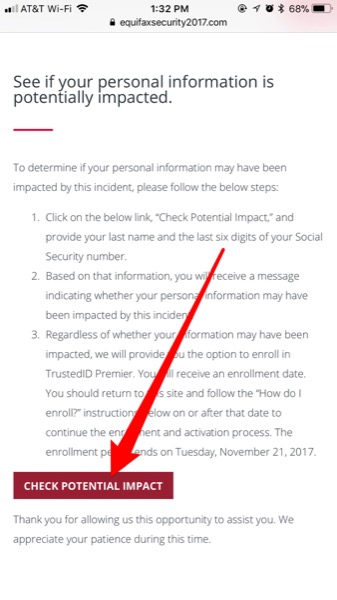

Next, after reading the text on the page, select “Check Potential Impact.”

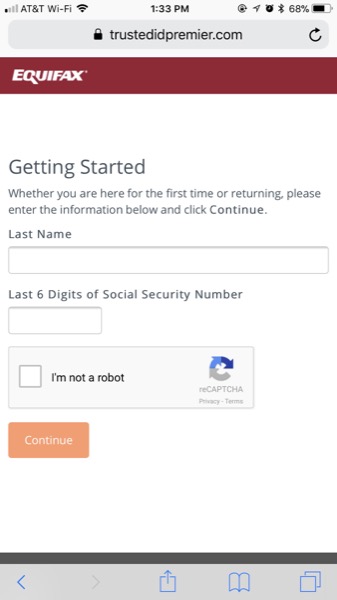

You’ll need to provide your last name and the last six digits of your Social Security number. Enter those, prove you’re not a robot, and click or tap “Continue.”

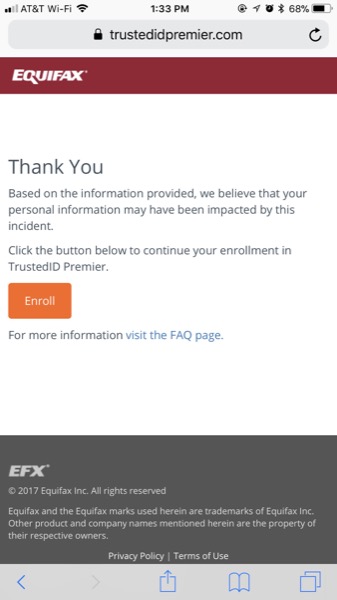

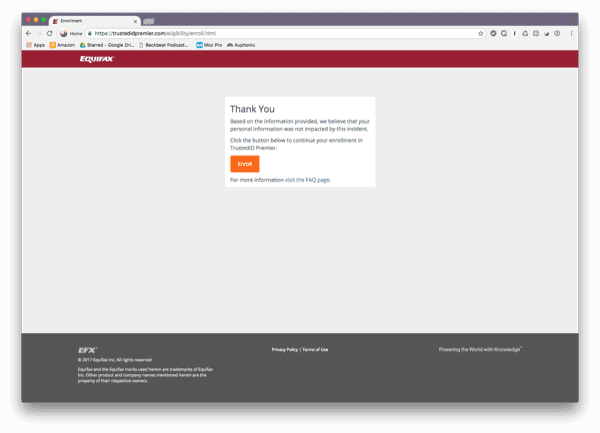

Next, you’ll learn whether the breach may have impacted you. The site also allows you to enroll for free in Equifax’s identity theft prevention product, Trusted ID Premier.

As the user screenshot below shows, you can enroll in Trusted ID Premier for free even if the cyber criminals didn’t get your data.

I Don’t Trust Equifax Anymore, What Other Choices Do I Have for Identity Theft Protection?

It is totally understandable for the 2017 Equifax breach to kill your confidence in that company. I’m still debating myself whether or not I’m going to take advantage of the free offer of Trusted ID Premier. Here are some other choices for identity theft protection products.

Remember, though, that none of these will be perfect. You will still need to actively monitor your credit reports, looking for unusual or unauthorized activity. The intelligence and sophistication of cyber criminals grows by the day.

FYI, they have updated the website with this:

The biggest problem here is we as consumers don’t have much of a choice here. I can’t call Equifax and cancel my account and take my business elsewhere. Nobody gets to pick who gathers this information and control our credit rating. The irony here is if anyone gets their ID stolen it’ll ruin your credit.

Yes, I had to chuckle at the line in the article that said “I Don’t Trust Equifax Anymore, What Other Choices Do I Have…”. The answer is none. They have your credit data. They are one of the places companies check for credit scores. There is not a d****d thing whatsoever you can do about it. The amount of pressure consumers or even the government can apply on them is precisely zero.

Not so sure about that, collateral damage to reputation and share price can deliver the ultimate kick in the pants.

Over this side of the pond, GDPR in the EU and the UK even after Brexit will make companies like Equifax look and act VERY differently towards data security. The fines are big enough to put organisations OUT OF BUSINESS, and rightly so. GDPR is in force from May 2018.

Did you notice in the small print that 44 MILLION UK residents are also impacted?, that is just about every adult in the country 🙁

As more and more companies get their reputations damaged from improper/inadequate security systems, the more these companies are opening themselves up to some serious lawsuits. Providing ID theft protection for one year (or three years) is totally unsatisfactory. Such companies should provide unlimited ID theft protection to their affected consumers with no expiration date. After all all, our identities do not expire, even after we do.