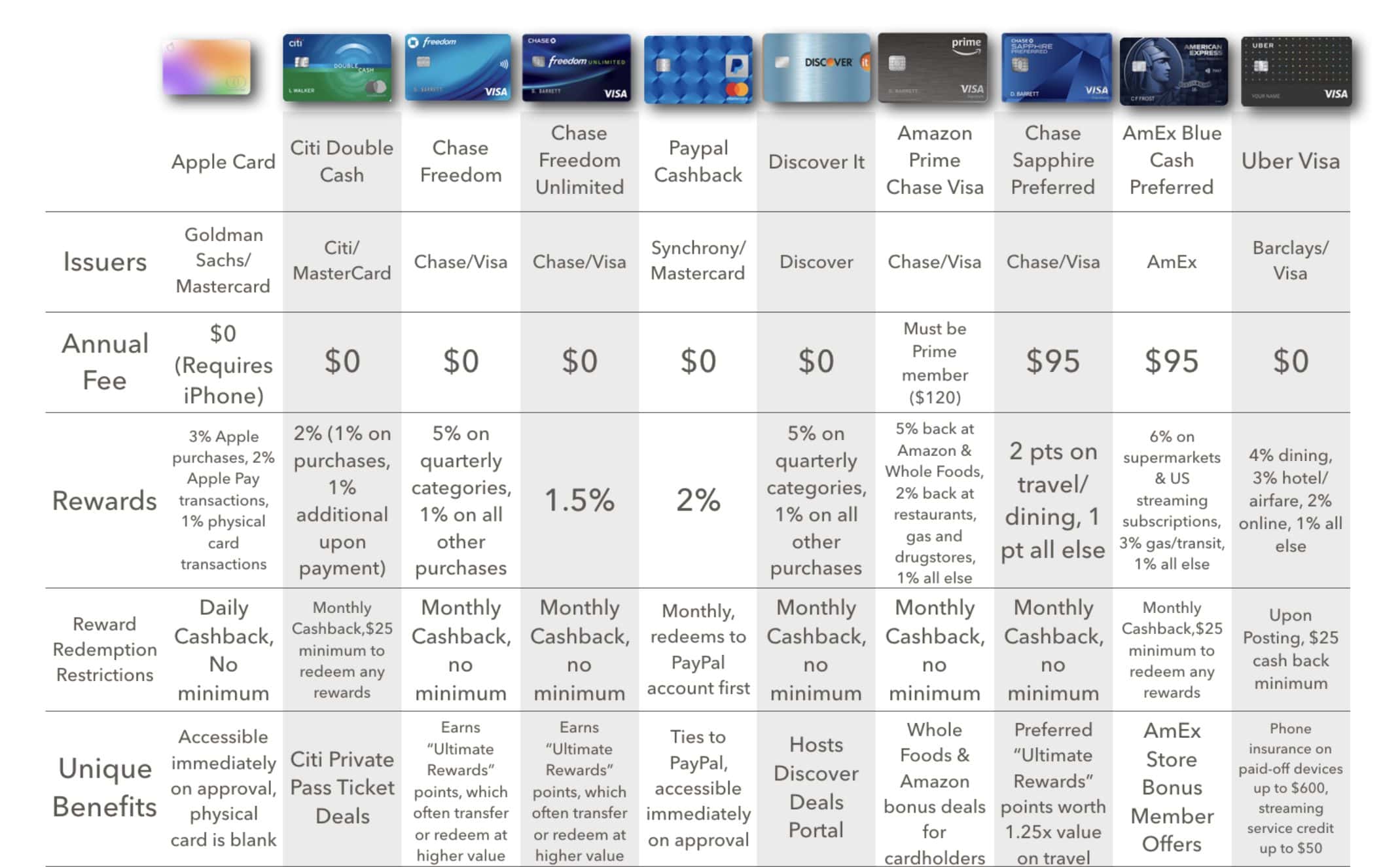

Redditor u/cannono put together a credit card comparison chart that shows you how the Apple Card stacks up against other cards (via The Loop).

Comparing Cards

The chart shows information for each card:

- Issuer

- Annual Fee

- Rewards

- Reward Exemption Restrictions

- Unique Benefits

Apple Card offers 3% cash back on Apple purchases, 2% for Apple Pay transactions, and 1% for using the physical card at retailers. The 1% reward is fairly low compared to other cards. However, if you use Apple Pay a lot or frequently buy Apple products, this card makes sense for you. It also gives you an easy tool in iOS Wallet to manage your payments.

In iOS 12.3 Apple started letting customers use Apple Pay for iTunes and App Store purchases. If you set up Apple Card as the default Apple Pay card, you could start earning 2% cash back when you buy apps, books, movies, and more from the App Store and iTunes.

Further Reading:

[iOS 12.3: How to Use Apple Pay in iTunes and the App Store]

Super great overview Andrew! Thank you!