Knowing how to transfer from Apple Cash to a bank account or debit card will streamline your everyday transactions, especially if you send and receive money often. A friend recently paid me back using Apple Cash, but I needed the funds in my bank account. Luckily, sending funds from Apple Cash was just a few taps away.

How To Transfer Apple Cash to a Bank or Debit Card

You have two options when transferring from Apple Cash to a bank account: standard bank transfer and Instant Transfer. Standard bank transfers are free but take one to three business days, while Instant Transfers usually reflect on eligible Mastercard or Visa debit cards in real-time. However, Apple will deduct a 1.5 percent fee from the total transfer amount.

Going with either method follows the same essential steps—let’s go through the process and observe the differences between them.

Transfer Apple Cash Through Standard Bank Transfers or Instant Transfers

NOTE

NOTE

Time needed: 2 minutes

To transfer Apple Cash to a bank account, follow these steps:

- First, open the Wallet App on your iPhone.

- Select your Apple Cash card.

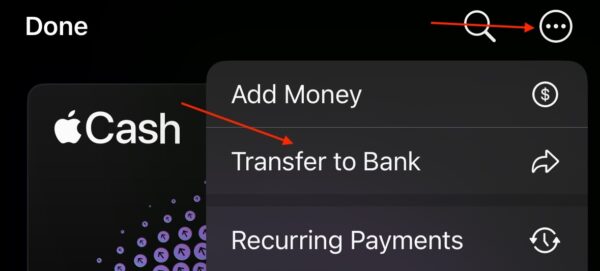

- Tap the horizontal ellipsis icon (…) to see more options.

- Now, tap Transfer to Bank.

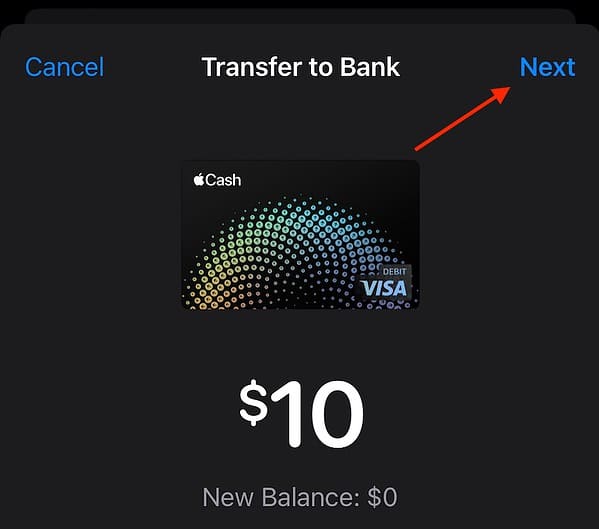

- Enter the amount you want to transfer and choose Next.

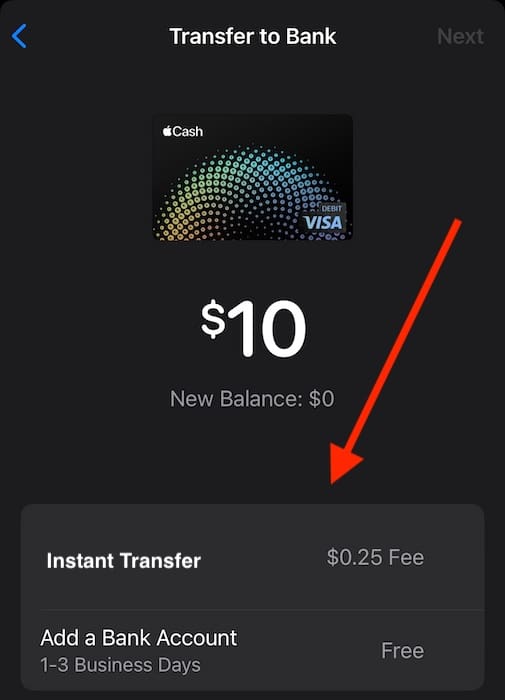

- From here either select 1-3 Business Days or Instant Transfer. Choose an eligible card. If there’s no bank account linked to your Apple Wallet, the app will prompt you to add one. Just follow the on-screen steps.

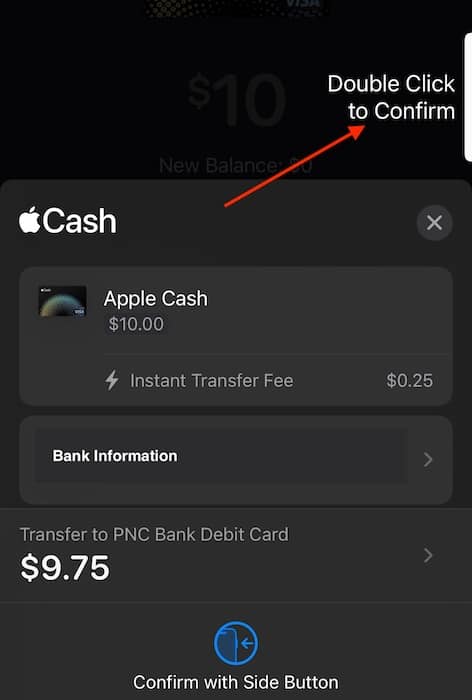

- Choose Next. Confirm the decision by double-clicking your iPhone’s side button and entering your Apple ID passcode, Touch ID, or Face ID.

- For those using an iPad, navigate to Settings > Wallet & Apple Pay > Apple Cash Card > Transfer to Bank. Then, follow steps 5 through 7.

At this time, Apple Cash will begin transferring the funds to the designated bank account.

What to Know About Apple Cash Transfers

Apple Cash users can transfer up to $10,000 within a single transaction and $20,000 within a 7-day period to their bank accounts. For those in a family plan, these amounts get reduced to $2,000 and $4,000, respectively. The minimum transfer amount is $1, but if your account has less than that, you can transfer your full balance.

There are also some things you should know about Instant Transfers. First, although Apple calculates the 1.5 percent transfer fee based on your total transfer amount, it has a minimum of $0.25 and a maximum of $15. Second, Instant Transfers aren’t always “instant.” Your funds are usually posted in real-time, but processing could sometimes take up to 30 minutes.

For minors who are part of an Apple Cash Family plan, know that children under thirteen cannot use Instant Transfer. Additionally, remember that if a user chooses standard bank transfers, Apple will observe the same holidays as the Federal Reserve, which may delay transfers.

Lastly, contact Apple Support if the money was not transferred after two hours using Instant Transfer or three days using standard bank transfers. You can also try our troubleshooting guide on what to do if Apple Cash is unavailable.

So this only works with visa? Not with a MasterCard?

Hello BoWCNM, sorry for the late reply, and yes, this works with a MasterCard.