If you’re in need of some of the best personal finance software for Mac in 2024, then consider this the first place you need to look. Managing your finances can be a daunting nightmare, but keeping your money right in this day and age is critical. Let’s take a quick rundown at some of the best ways to manage your money on Mac.

Best Personal Finance Software for Mac Ranked

There are plenty of options for some of the best personal finance software for Macs. Note that this is just a quick overview of each app, as there is simply not enough space for a full review of each one. Think of this guide as your entry into the world of financial software for Mac.

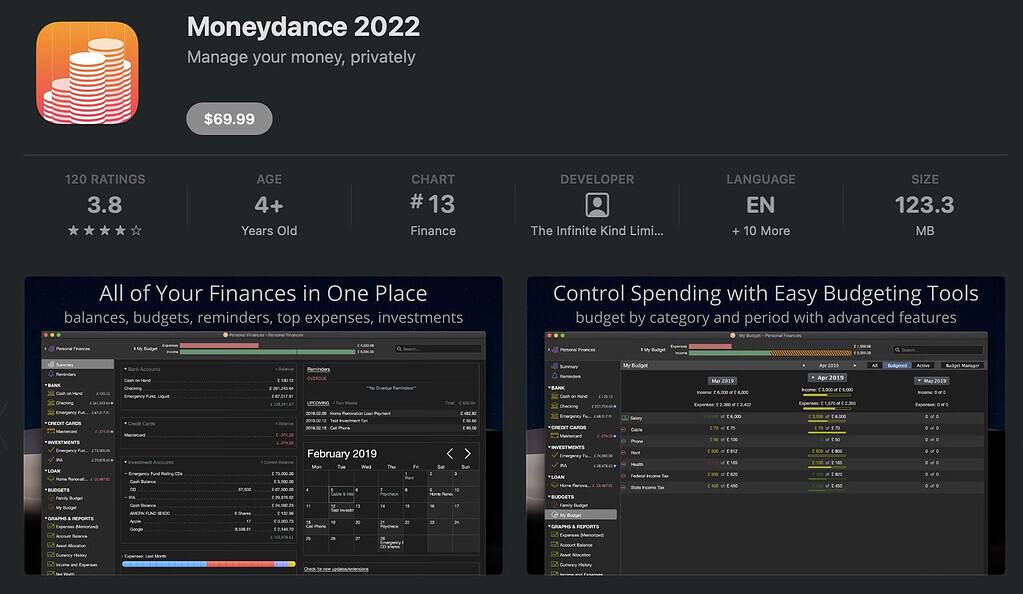

1. Moneydance

Moneydance covers a lot of your bill payments and online banking, investing, and budget tracking, but it does with your privacy at the forefront. Refusing to even take analytics on your data, Moneydance also offers end-to-end encryption when syncing over the cloud, and personal encryption on your device. What I really like about this one is that it also provides a mobile version, meaning you can track your finances on the go.

While this one can be great, some users within the Apple App Store do note of syncing issues, with one user complaining they didn’t learn their bank wasn’t supported until after the fact. Be sure to look at all the details before checking out this one, but I think it’s a good buy for the price.

Price: $69.99

System Requirements: macOS 10.11 or later

Pros

- Offers mobile version.

- Good for beginners and those with experience.

- Pleasing UI.

Cons

- May have some syncing issues.

- Goes long periods without updates.

2. Mint

In addition to offering a wide range of financial resources conveniently centralized to one app, Mint also provides tax preparation through a partnership with Intuit TurboTax. This means you have a single app to check and manage all of your finances, but you can also prep and file your taxes with Mint as well. This is one of the best apps currently available, but it includes so many features that one of them is a warning.

While Mint is practically beloved universally, there is one major downside in that it’s likely to reach the end of its life by March 2024. However, the app was supposed to shut down at the beginning of 2024 and has yet to do so. You’re likely taking a risk by signing up for this app, but many may find the experience to be worth it.

Price: Free

System Requirements: Internet Browser for Mac. iPad/iOS 15 and/or watchOS 6

System Requirements: Internet

Pros

- One of the most comprehensive financial management apps.

- Cannot beat the price.

- Easy to use, great for beginners.

Cons

- Likely shutting down in March 2024.

- No native Mac app.

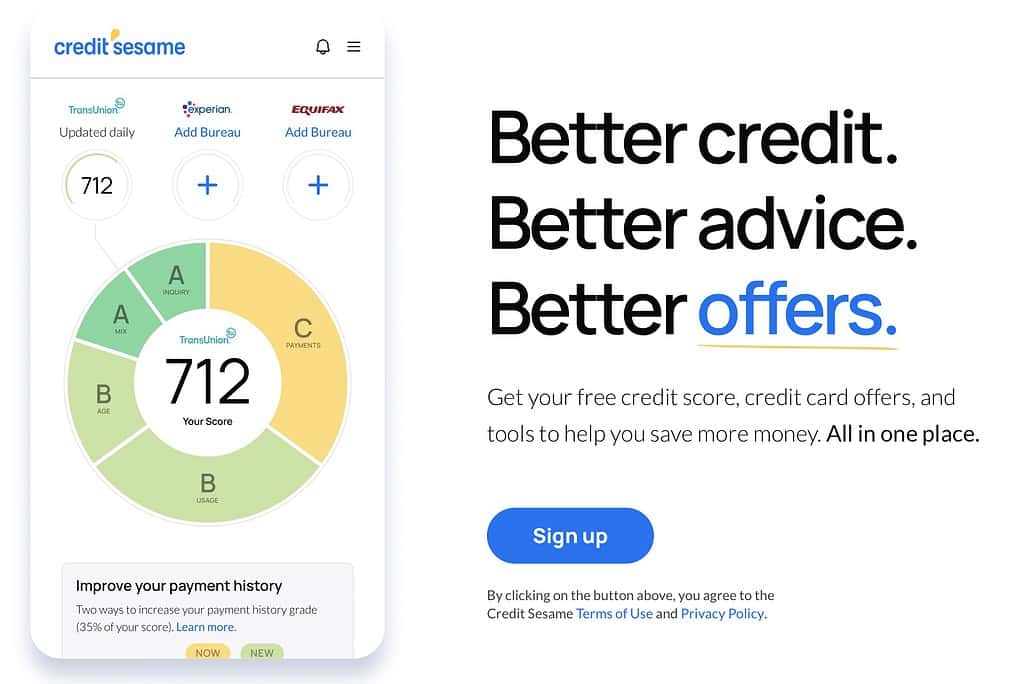

3. Credit Sesame

Credit Sesame is a great way to keep up with your credit. In addition to being able to access your credit score for free, Credit Sesame also gets you in touch with some of the best offers for home, auto, and personal lines of credit. Additionally, Credit Sesame gives you updates on your credit accounts, letting you know what actions you need to take.

However, bear in mind that the free version only gives you access to your VantageScore. This is different from your FICO score, which is what creditors typically use to determine your offers. Bear in mind, that it may not be worth it to pay to gain access to all of your credit scores, though getting a free credit score can help you determine where you stand financially.

Price: Free, but does have premium features

System Requirements: Internet browser or iPhone/iPad

Pros

- Great for keeping tabs on your credit score and history.

- Offers free identity protection, valued at $50,000.

- Can help build credit.

Cons

- Free users only get access to one credit score.

- Only offers in-browser options for Mac.

- Other apps offer more expansive features for various areas of finance.

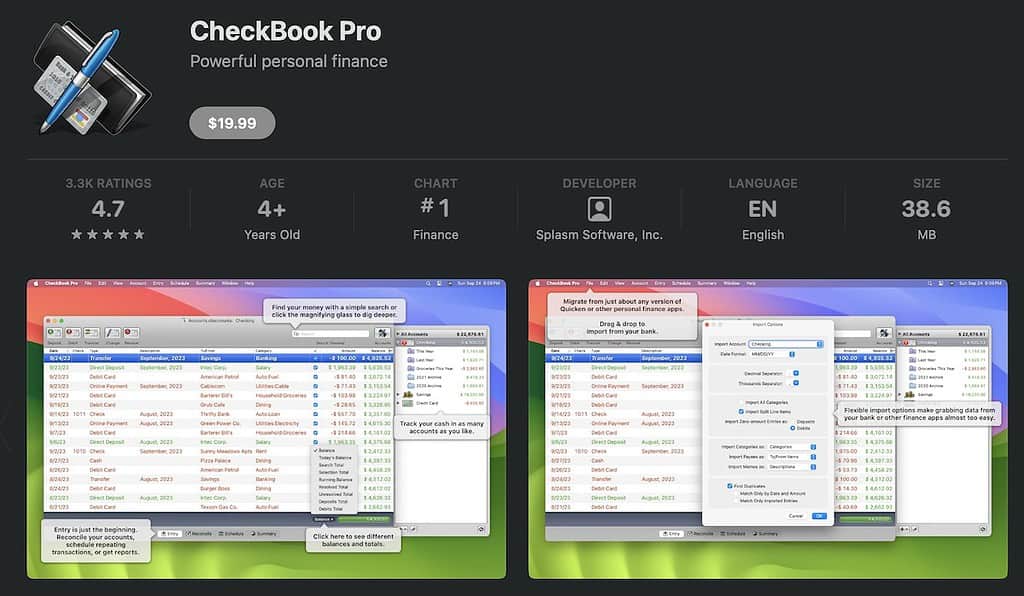

4. Checkbook Pro

With the number one rating in the Finance category for paid apps on the App Store, there’s a reason people turn to Checkbook Pro. While this is the Pro offering of Splasm Software’s Checkbook app, paying the extra five dollars to access all of their features is worth it. If you’re looking to manage your finances and spending habits, Checkbook Pro makes it easy.

Perhaps the feature that will be most useful to users is the ability to easily create a report of your finances. See where your money is going and how you’re spending across all of your accounts with ease. The only downside is that some folks may be looking for a finance app that goes beyond simple budgeting and management. If you’re looking for something jammed to the brim with features, you may want to keep looking.

Price: One-time fee of $19.99. Basic version $14.99

System Requirements: macOS 10.11 or later

Pros

- Top-ranking financial software.

- Manage and organize your finances through reminders of auto-pay bills.

- Ability to print checks without using special paper.

Cons

- Users may want more frequent software updates.

- May not be as robust as some users would like.

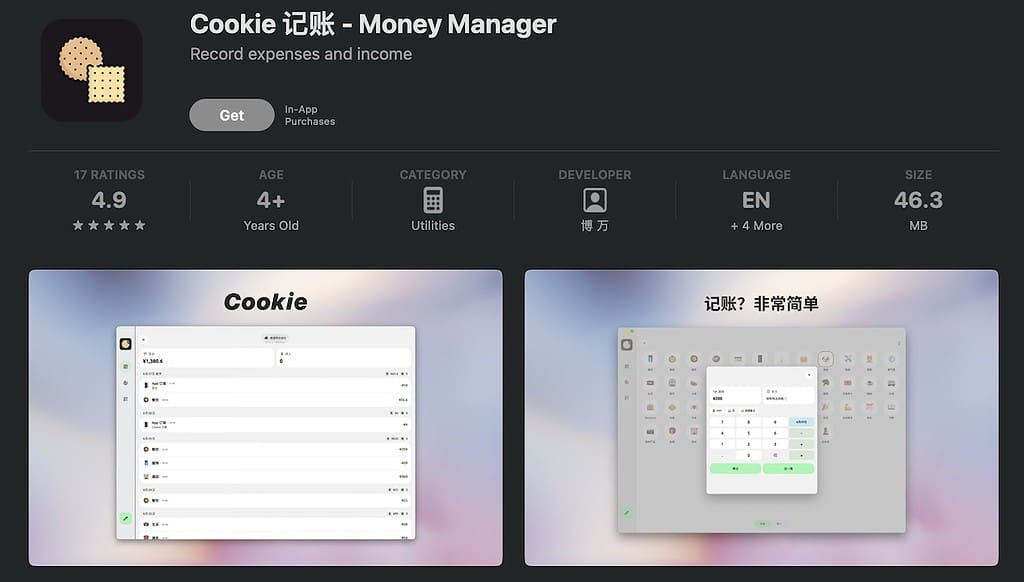

5. Cookie

If you’re looking for financial software that provides a fantastic interface and experience, Cookie may be for you. For those looking for the “meat and potatoes” of financial planning, you may want to start here. One of the best reasons to go with this ad-free financial software is that it offers syncing to the Cloud. It can also show you where your money is trending over different periods, giving you a broader idea of your spending habits.

Great if you’re trying to budget your money, Cookie is also free but does offer a subscription service. One nice thing about the subscription service is that you can opt to buy out, giving yourself a lifetime license. This means you can try the pro features if you want and then you can purchase a lifetime pass or decide to stick with the free version. It’s good for the basics, but those with thicker portfolios may want to keep looking.

Price: Free. Subscription for premium is $6 a month, $30 per year, or $68 for a lifetime

System Requirements: macOS 11.0 or later

Pros

- Great aesthetic with the option to change themes.

- Features a currency converter.

- Great privacy features, including automatic blur.

Cons

- Really just for budgeting and financial management.

- Subscription options may be confusing.

- May not be for financial beginners.

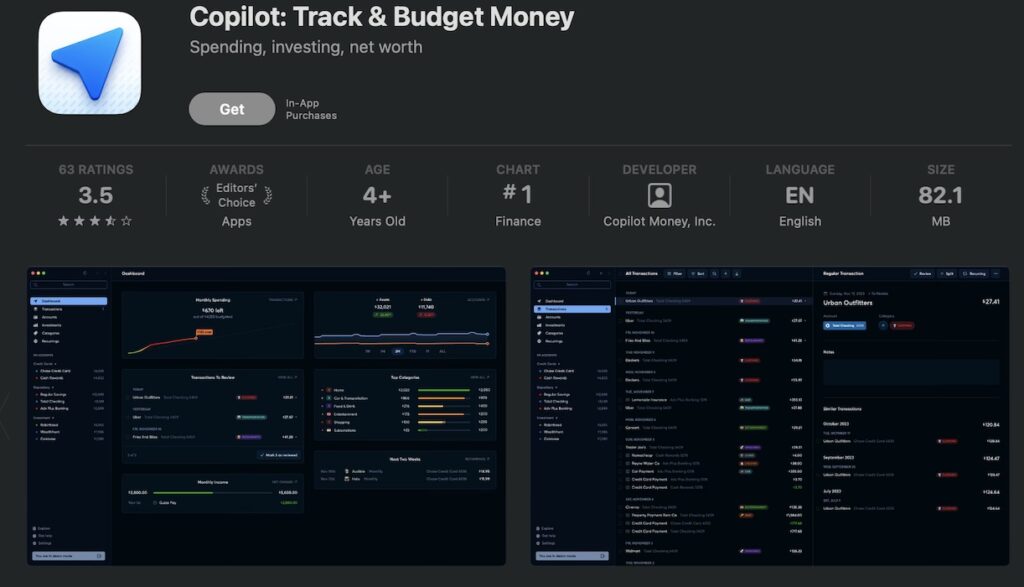

6. Copilot

We took a look at the number one paid app in the App Store, and now let’s take a look at the number one free app. While the app is free, Copilot does require a subscription. However, they do give you a month free, and there’s a reason the app was a 2023 App Store Awards Finalist. What makes Copilot a great financial app is that it puts privacy and security first. Copilot promises the same security you would get from a bank and also refuses to sell your information.

In addition to the privacy tools, Copilot also offers AI-powered insights. This tool helps you categorize your spending better, providing you with better details on where your money is going. Copilot users can also track their investments and customize their alerts so they’re not being harassed with notifications all the time. However, you may want to take a look at reviews on this one, as some users address issues with bugs.

Price: $13 a month or $92 annually

System Requirements: macOS 12 or later, iPad/iOS 15 or later

Pros

- Offers more tools than many of its competitors.

- Light Mode and Dark Mode options.

- May provide some of the best insights into your spending.

Cons

- Requires a subscription.

- May have syncing issues with some financial accounts.

- Users on App Store complain about bugs with certain transactions.

7. Quicken

There’s a pretty good chance you’ve already heard of this one, as it’s been a mainstay in finances for years. A trusted name in the industry, Quicken looks at your finances not just in the present, but looks to your future as well. One feature that really stands out about this app is that in addition to budgeting and investing, Quicken allows you to pay 12 electronic bills a month directly through the app. If a bill doesn’t take online payments, that’s okay. Quicken can also print and mail up to five checks a month to anyone in the U.S.

While there are plenty of things to love about Quicken, the way they manage their software may leave a lot to be desired. The company offers several different packages, so you may want to explore your options. If you want extra features such as the Lifetime Planner, which can help you save for your retirement, and “what-if” tools that can help you manage your debt, you may want to take a look at Quicken Classic: Deluxe.

Price: Varies. Quicken offers multiple solutions depending on your needs

System Requirements: macOS 12 or later

Pros

- Offers a variety of options to suit an individual’s finances.

- Top-tier packages include great features for budgeting debt and planning for retirement.

- Decades of experience in the industry.

Cons

- Software variety may cause confusion for those looking to buy.

- Not available in the Apple App Store.

- May not be “cutting-edge” tech for some.

8. YNAB

Personally, I like this one because it has a focus on those who are diving into the world of financial planning for the first time. For starters, it’s good to have a plan with finances, and YNAB seems to understand that. A big feature that helps YNAB stand out is that it offers apps across iPhones, iPads, and Macs that automatically update. You can also share YNAB with up to five people, meaning you can budget with those close to you.

Like many of the other offerings on this page, YNAB offers a month to give the program a try. Considering how much this one focuses on debt, this would be a good one for those who may feel like they’re in over their head. However, if you’re not so worried about debt, you may want something that focuses more on investing or other areas of financial planning.

Price: $14.99 per month or $99 annually

System Requirements: Internet browser

Pros

- Good for those just getting a start in the world of finances.

- Focuses on debt relief.

- Available across multiple devices.

Cons

- Those with more financial experience may want something more robust.

- Doesn’t track bills or investments.

- May not give the clearest picture of your overall finances.

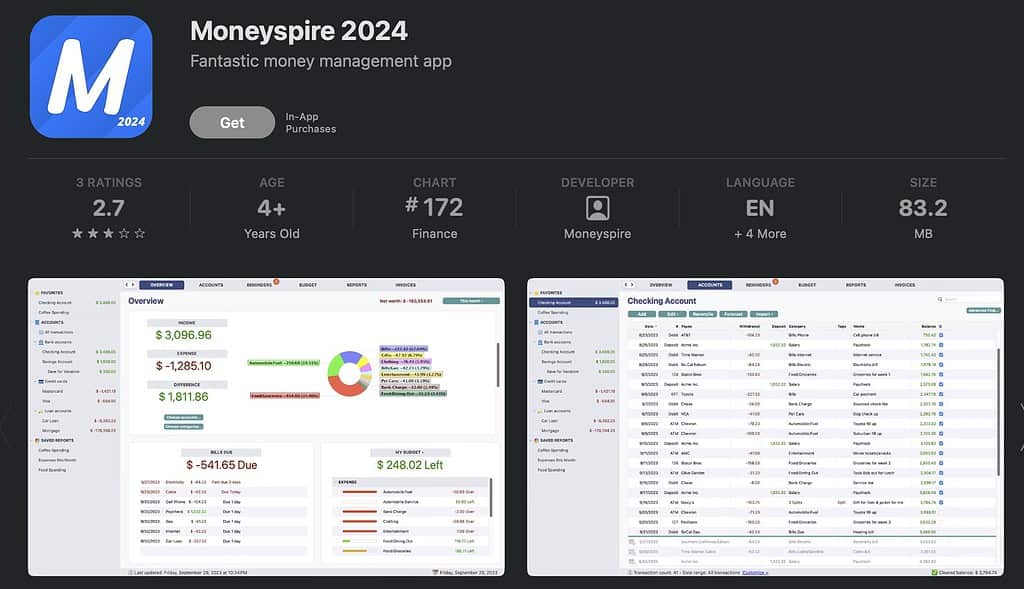

9. Moneyspire

This one is another for those who are looking for a simple way to track their finances. Think of Moneyspire as the little brother of Quicken: not as many features, but it still knows how to get the job done. This one is good for financial tracking and planning, with options for interactive reports and seeing what future finances you may have.

While Moneyspire is good, some may find the UI to be unappealing. However, those who are looking for something for a small business may want to consider this one over the others. Offering a family plan/team plan does push this one ahead of the competition, but those looking after themselves may want to consider their options.

Price: One-time price of $69.99 for Standard (optional $39.99 family plan) or $99.99 for Pro with Invoicing (optional $69.99 team plan). Though requires a new license with each upgrade to the app

System Requirements: macOS 10.10 or later. iPad/iOS 11 or later

Pros

- Doesn’t require a subscription.

- Offers cloud syncing and bank account linking.

- May be more robust for those running a small business.

Cons

- Other apps may offer more.

- UI could use some work.

- May need to purchase again with an update (if you want the upgrades).

So, Which One Works Best?

You may not like this answer, but it really depends on what you need to do with your finances. If you’re planning more for investing, Copilot of Quicken may be for you. If you’re worried more about debt relief, you may want to consider YNAB. Finances are unique to each individual, so consider what you’re looking for in finance software.

At the end of the day, your finances are most important to you. Consider this list and do your due diligence before taking the plunge on software. You’ve already made the right decision by making the first step, there’s no need to rush a decision.

Why Does Personal Finance Matter?

Personal finances matter because some of the best freedom is financial freedom. Knowing where your money is going and what’s happening with it can help prevent future emergencies and ensure everything looks brighter and brighter. Taking care of your finances now ensures you’re not taking care of them later. This is why I stress the importance of researching deeper into many of these applications; time spent now is money earned later.

If you’re interested in finances, you may also want to consult our guide and using and transferring Apple Cash.

You left out Banktivity and iFinance

Also good choices, yes!

We have used Moneyspire for the last 3 years.

Really like it.