Apple today finally rolled out the much-anticipated iOS 17.5, iPadOS 17.5, and macOS Sonoma 14.5 for iPhones, iPads, and Macs.

Apple and Google Finally Team Up to Protect Users from Unwanted Tracking

Apple & Google team up! iPhones & Androids get new alert to warn of unwanted tracking by Bluetooth devices.

Apple’s Upcoming Native Ad-Blocker in Safari Worries UK Media Group

UK’s Media group has warned Apple that any such move to push native Ad Blocker in Safari would put their businesses (or journalism) at risk.

Less Than 0.1% of Developers Sign up for Apple’s New Payment System

Judge doubts Apple’s App Store payment changes address anti-trust concerns. Few developers use new system due to high fees.

You Can Now Play PS1 Games on iPhone with Gamma Emulator

Gamma is free to download on the App Store!

iPhone 16 Pro Will Reportedly Sport 20% Brighter Display

Apple’s upcoming iPhone 16 Pro could sport an upgraded display, according to a new rumor coming out of China.

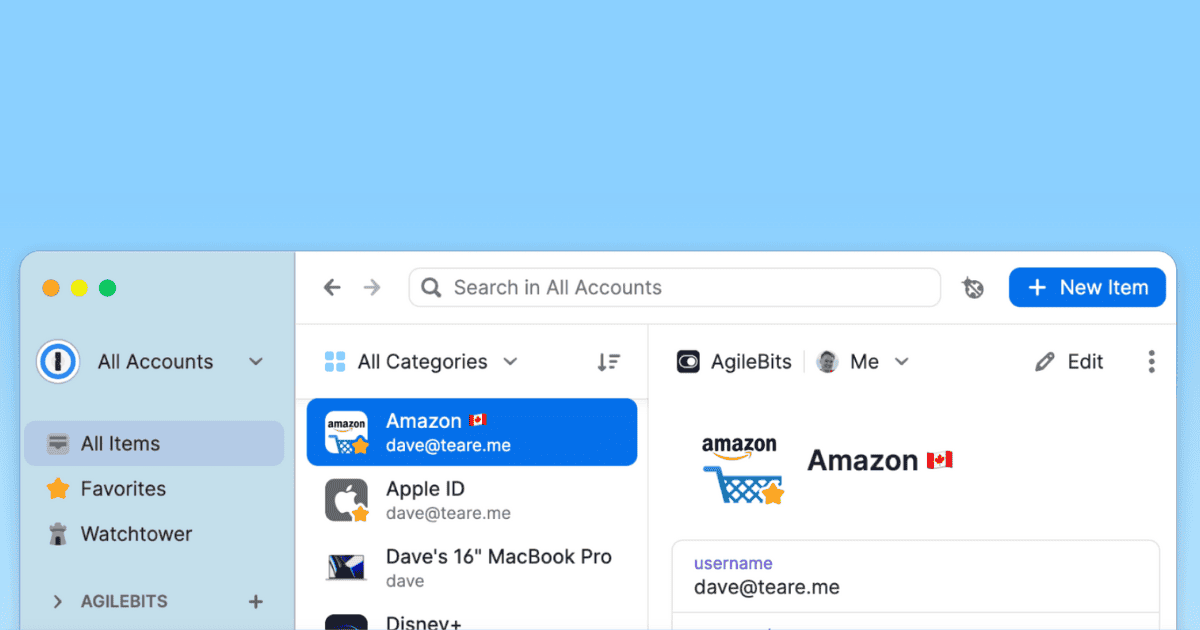

1Password for Mac Review: Is It the Best Password Manager?

Want to know how 1Password stores passwords and logins on your Mac? Read our hands-on review to learn all about this password manager.

10 Fun Games That You Can Play on a Mac Without a Mouse

Check out this list of the best Mac games you can play without using a mouse. Choose your favorite and get started now.

Apple Inches Closer to Bring ChatGPT-Powered Features to iPhone: Report

Apple is inching closer to closing a deal with OpenAI to leverage the popular AI chatbot, ChatGPT, for upcoming iPhone AI-focused features.

Is Apple News Worth It in 2024? A Quick Review

Is it worth paying a subscription to Apple News in 2024? Apple’s news aggregator has a lot to offer, though it may not be for everyone.

5 iPad Cases That Are Compatible With a Magic Keyboard

Are you looking for an iPad case that’s compatible with a Magic Keyboard? Check out our top options based on durability, value, and style.

Microsoft Announces Web-Based Xbox Games Store for iOS and Android

Microsoft is finally bringing its Xbox game store to iOS and Android this summer, confirming the previous reports.

Apple Mentioned 'AI' 8 times During 'Let Loose', and It's Not Just Talk

During the 38-minute-long keynote, Apple mentioned the term “AI” like eight times in several contexts. It seems like the Cupertino giant is bulling on AI after all.

WhatsApp for iOS Gets a Major Design Overhaul

Latest WhatsApp update for iOS offers redesigned UI, new buttons, enhanced Dark Mode, and much more.

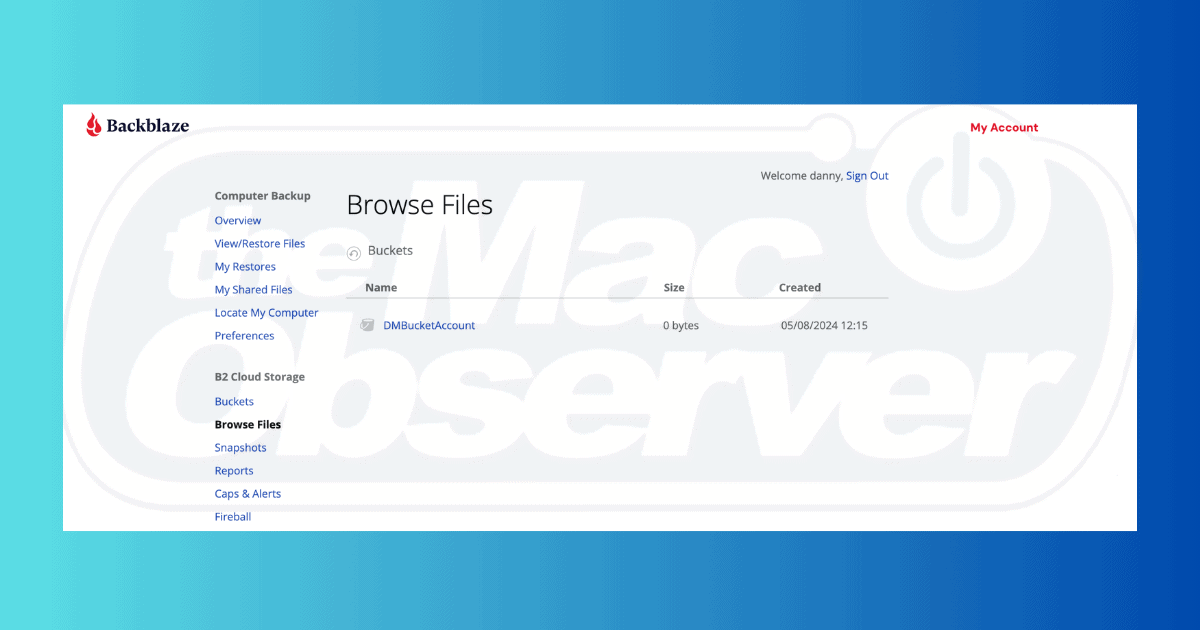

Backblaze Review: Is It a Worthy iCloud Alternative?

Does iCloud Drive not suit your needs? In this review, I’ll discus whether or not Backblaze is a good cloud storage solution for Mac.

Top 8 GPTs To Use With Your ChatGPT Plus Subscription

Discover the best ChatGPT GPTs to enhance your productivity, creativity, and workflow efficiency on your Mac.

Is Apple Arcade Worth It in 2024? The Good and the Bad

Knowing all the facts about Apple Arcade can help you decide if the service is worth it in 2024. Our full guide gives you all the details.

Top iPad Pro M4 Case for Style and Durability

If you’re on the lookout for a new iPad Pro M4 case, check out this complete comparison. You’ll discover eight of the best options.

Apple Vision Pro Is Already being Used For Stomach Cancer Treatment and Surgeries in India

An Indian doctor claims that he has used Apple Vision Pro in more than 30 surgeries, so far, and plans to keep using it when needed.

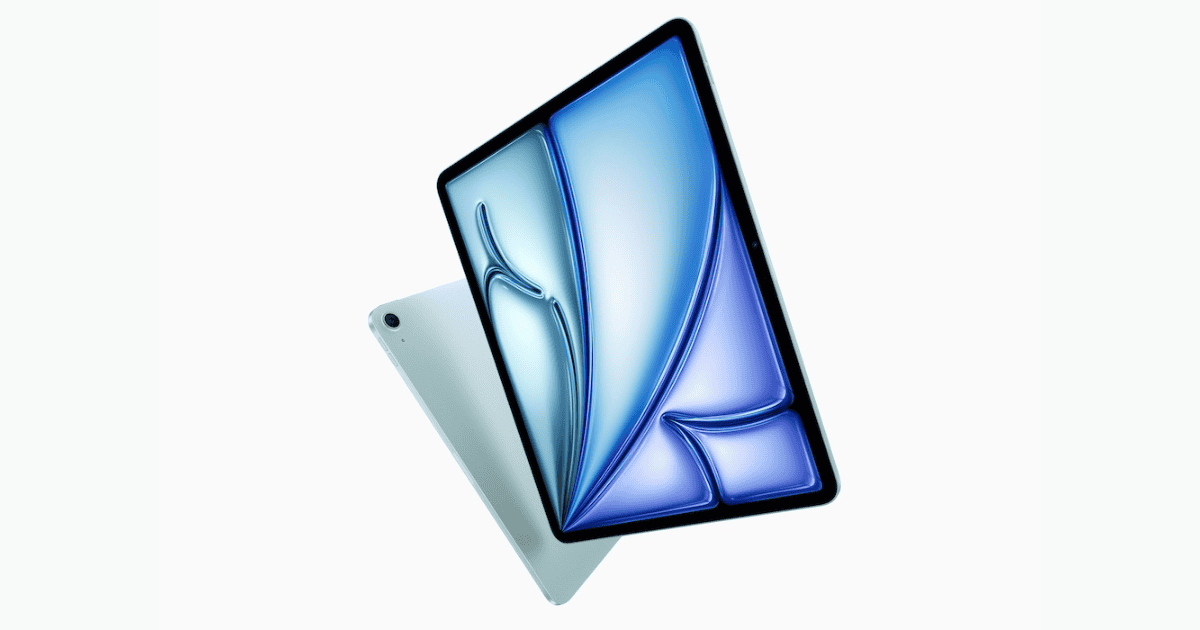

Best iPad Air 13-Inch Cases For Protection and Value

With the release of the 13-inch iPad Air, I’ll take a look at the best cases that protect your device—and your wallet.

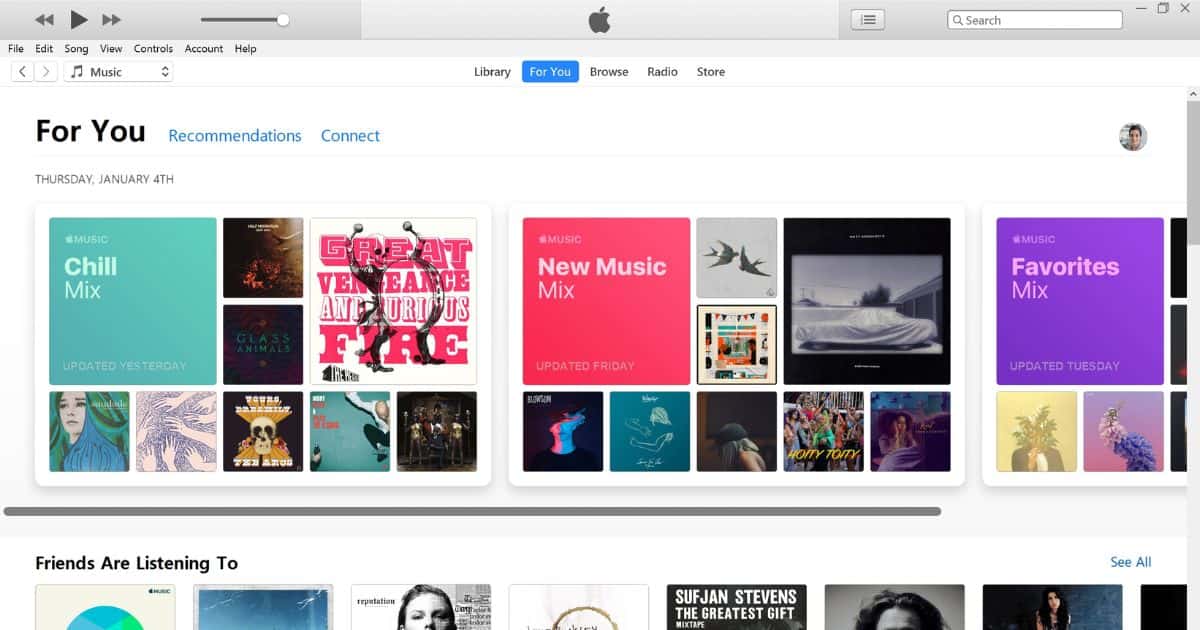

Apple Refreshes iTunes for Windows, Adds Support For New iPads

Apple today refreshed the iTunes app for Windows adding support for the newly launched 2024 iPad Air and iPad Pro models.

Alleged M4 Chip Benchmarks Tip the Scales Against M2 and M3

One thing that is still unknown about the M4 chip is how it stacks up against M2 or M3. However, alleged benchmarks put that into perspective.

Storage Upgrades Help Apple Maintain Strong Revenue Despite Flat iPhone Sales

Even with stagnant iPhone sales, Apple leverages high-storage upgrades (44% choose them!), boosting revenue thanks to significant price increases and low component costs.

2024 iPad Air, iPad Pro Suggest eSIM-only iPhone Could Expand To More Countries

Cellular versions of 2024 iPad Air, and Pro are ditching the SIM tray in favor of eSIM which might hint we will see eSIM-only iPhones soon.