Now through April 22 Apple will donate US$1 to Conservation International for every Apple Pay transaction made with Apple.

Search: apple pay

QuickTrip Rolls out Support for Apple Pay at Gas Pumps

A report on Monday shows that QuikTrip is rolling out support for Apple Pay at its gas pumps.

Apple Pay Launches in South Africa for Contactless Payments

Contactless payment service Apple Pay has launched in South Africa, joining Samsung Pay which launched in the country in 2018.

The UK Contactless Payment Limit Has Gone up, But it Will Have Little Impact on Apple Pay

The UK limit on single contactless transactions – those that you can simply tap your card to make, no pin or signature required – has increased to £100. However, as Ben Lovejoy at 9to5 Mac noted, this will have little impact on those who want to use Apple Pay to purchase goods as the limit was already significantly higher than that. (In the U.S. of course, the situation is different with different ceilings on when a signature etc is required.)

Apple Pay uses a more sophisticated form of contactless payment reserved for mobile wallet devices that have biometric authentication. With this protocol, banks and retailers can set a much higher payment limit, or even have no limit at all, because the device verifies the identity of the user via Face ID or Touch ID in the case of an iPhone, or the PIN you entered on an Apple Watch when putting it on in the morning. When I asked at the time of launch, my bank hinted that its own limit was £750 ($1,050), and certainly I have made three-figure purchases using Apple Pay. Some people report successfully using Apple Pay for mid-four-figure purchases.

Crypto Provider BitPay Adds Support for Apple Pay

BitPay provides cryptocurrency payment services and announced on Friday that its BitPay Prepaid Mastercard can be added to Apple Wallet.

Get Online Valentine’s Day Deals With Apple Pay

In an email sent to customers, Apple is offering special online deals when you shop using Apple Pay. This round of deals is for Valentine’s Day.

Get Four Months of Free Unlimited Coffee With Apple Pay and Panera Bread

Apple is partnering with Panera Bread on a deal for the MyPanera+ Coffee subscription. Sign up through January 27 for perks.

New York City Subways Complete Apple Pay Support

Subways in New York City have finished rolling out support for contactless payment methods such as Apple Pay using the One Metro New York.

Amtrak App And Website Now Supports Apple Pay

Amtrak customers can now use Apple Pay, as well as Google Pay and PayPal, to purchase tickets on its mobile app and website.

Dutch Antitrust Probe Targets Contactless Payments Like Apple Pay

The Netherlands Authority for Consumers and Markets announced on Friday the start of an investigation into payment apps and NFC.

Money Management App ‘Yolt’ Now Supports Apple Pay

Financial tech company Yolt has introduced support for Apple Pay. This means customers can pay with their Apple Watch or iPhone.

The Salvation Army Supports Apple Pay Donations

The Salvation Army supports donations through contactless solutions like Apple Pay and Google Pay, perfect for this year’s pandemic.

Credorax Adds Support for Apple Pay

Bank Credorax announced on Wednesday that it added support for Apple Pay to its payment method list.

Credorax reported that both methods may now be added to merchants’ accounts as payment options for their shoppers alongside the more than 150 global payment methods the platform offers.

Walmart Stores in Canada Now Support Apple Pay

It seems that Apple Pay support is rolling out in Walmart stores across Canada as terminals receive contactless payment readers.

Apple Pay Now Available to Bank of Ireland Customers

Bank of Ireland announced that its customers can now use Apple Pa, following the rollout of the bank’s new app.

Apple Pay Set to Launch in Israel

Apple Pay looks is heading to Israel, the Isracard Group has told the country’s stock exchange, with other credit card firms also involved.

Fibank Now Supports Apple Pay With Visa Cards

Bulgaria’s First Investment Bank (Fibank) supports Apple Pay for its customers with debit or credit Visa cards.

New ‘LAX Order Now’ Food Ordering Website Supports Apple Pay

The Los Angeles International Airport (LAX) launched its mobile food ordering platform called LAX Order Now, supporting Apple Pay.

EU May Force Apple to Give Rivals Access to Apple Pay Tech

Apple may have to open up its Apple Pay technology rival providers. That’s according to a EU document due to be published next week, seen by Bloomberg News.

The report is set to be unveiled next week by the European Commission as part of a package of policy proposals. It includes a footnote to a competition case launched by the European Commission’s antitrust arm in June, which is seeking to assess whether the iPhone giant unfairly blocks other providers from using the tap-and-go functionality on its smartphones. “In parallel with its ongoing and future competition enforcement, the Commission will examine whether it is appropriate to propose legislation aimed at securing a right of access under fair, reasonable and non-discriminatory conditions, to technical infrastructures considered necessary to support the provision of payment services,” the EU says in the document.

Apple Pay Express Transit Now Works With LA Metro TAP Card

After some delay, the Apple Pay Express Transit now works with the Los Angeles Metro Transit Access Pass as well as in Washington, D.C.

Germany’s Sparkasse Bank Supports Apple Pay

Apple Pay users in Germany can now add their Sparkasse Giro debit card (Sparkassen-Card) to iOS Wallet, just like their credit cards.

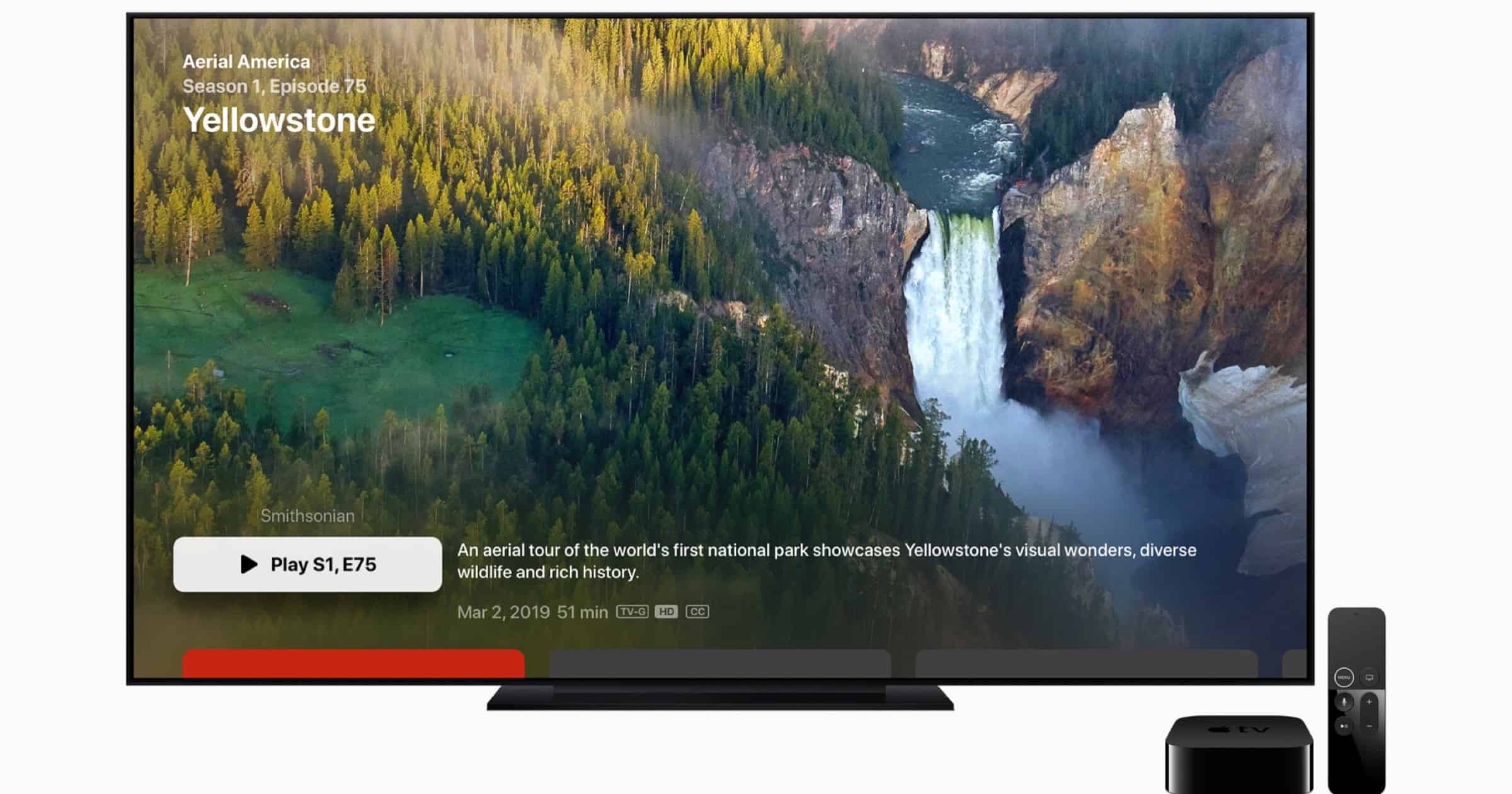

Celebrate National Parks’ 104th Birthday With Apple Watch, Apple Pay

The U.S. National Park Service celebrates its 104th birthday on Tuesday. Apple will donate US$10 for every purchase made with Apple Pay.

UBS Switzerland Adds Support For Apple Pay

The Union Bank of Switzerland is the largest Swiss banking institution in the world, and it just added support for Apple Pay.

LSU Students Can Use Apple Pay in Parking Meters

Starting Monday, August 17, students at Louisiana State University will be able to use Apple Pay in parking meters across campus.