Discover the best Mac wireless keyboard and mouse combos in this complete guide. We’ll outline 10 of our favorite options.

Sketchy Rumor Suggests Next iPad Air Will Pack an M3 Chip

The next-generation iPad Air is rumored to feature an M3 chip…and we wonder, why not an M4?

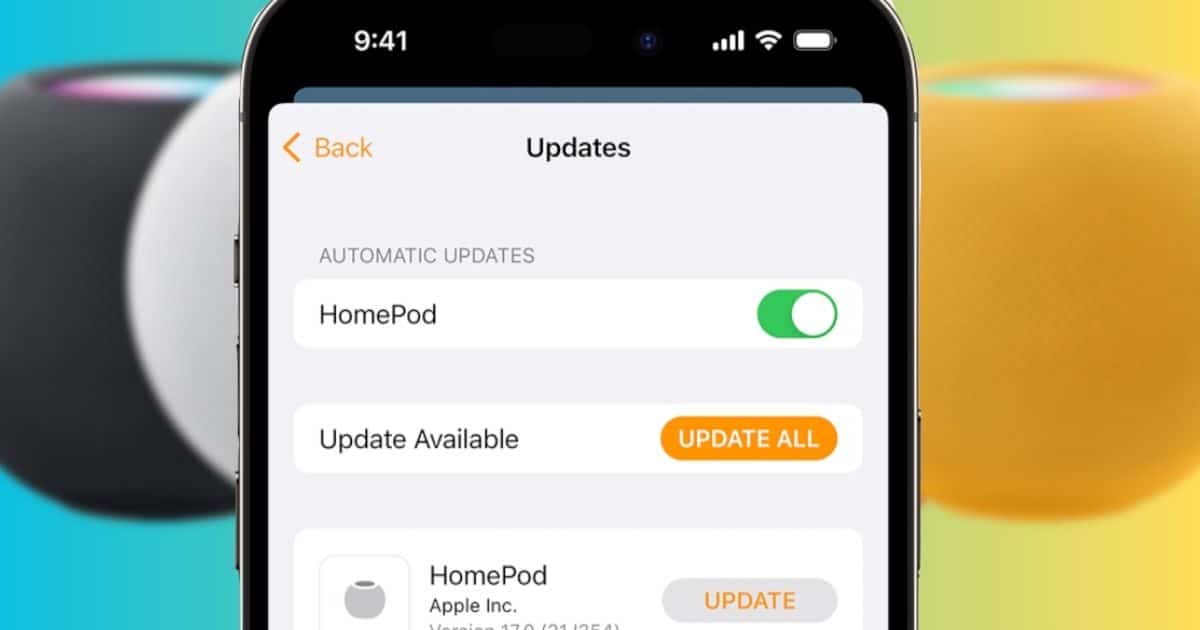

How to Install HomePod 17.5 Software Update

Is it time to update your HomePod software? Here’s a full guide on how to install the latest HomePod software, 17.5.

How to Install tvOS 17.5 on Your Apple TV

Here’s how to download and install the tvOS 17.5 update. Although there aren’t any new features, multiple bugs have been fixed.

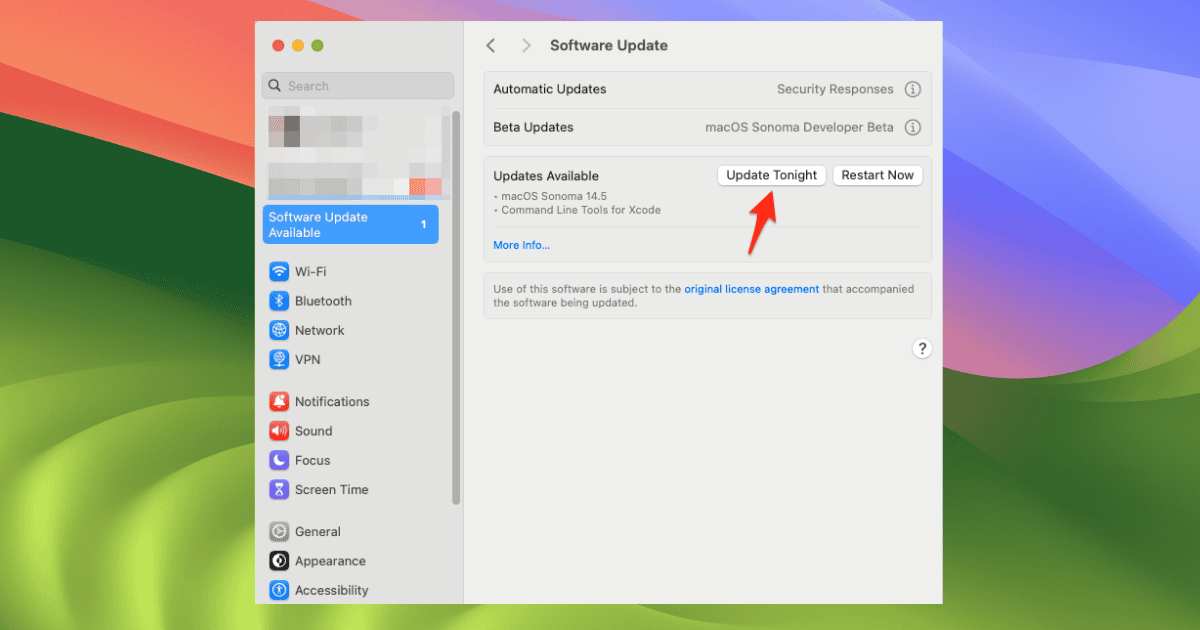

How To Install macOS Sonoma 14.5 on Your Mac

macOS Sonoma 14.5. is here. Check out this quick guide to update your MacBook and install the latest version.

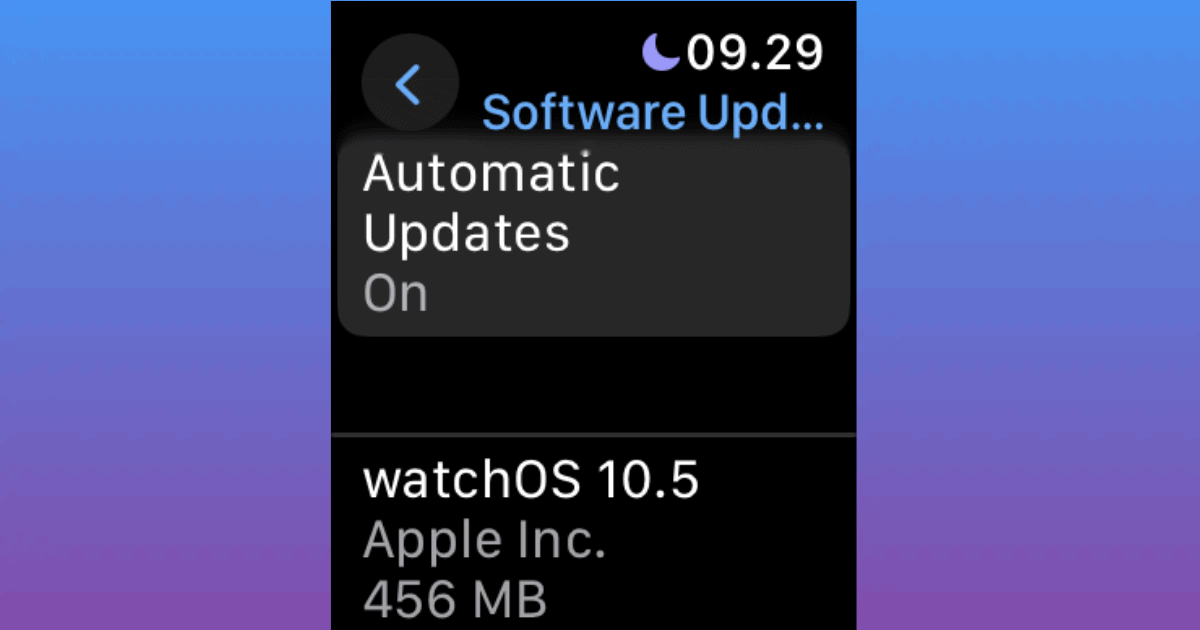

How To Install watchOS 10.5 on Your Apple Watch

Is the new watchOS update worth it? Here’s a full guide explaining how to install watchOS 10.5, plus what features it offers.

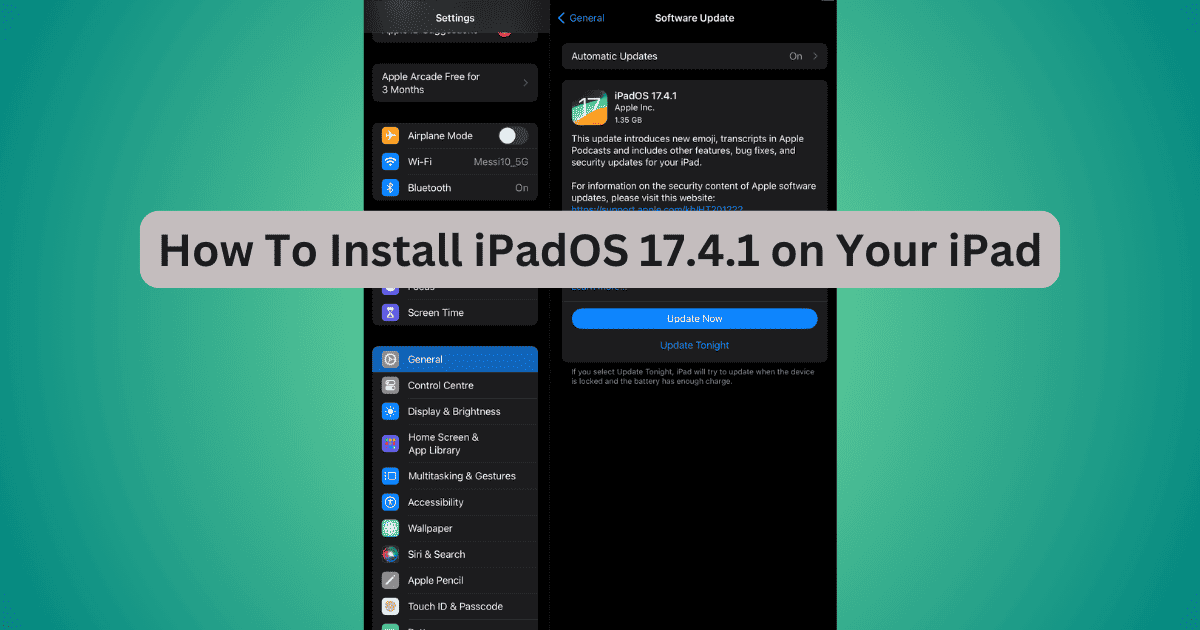

How To Install iPadOS 17.5 on Your iPad

Find out how to download and install iPadOS 17.5. Discover device compatibility, backup procedures, and steps for a seamless update.

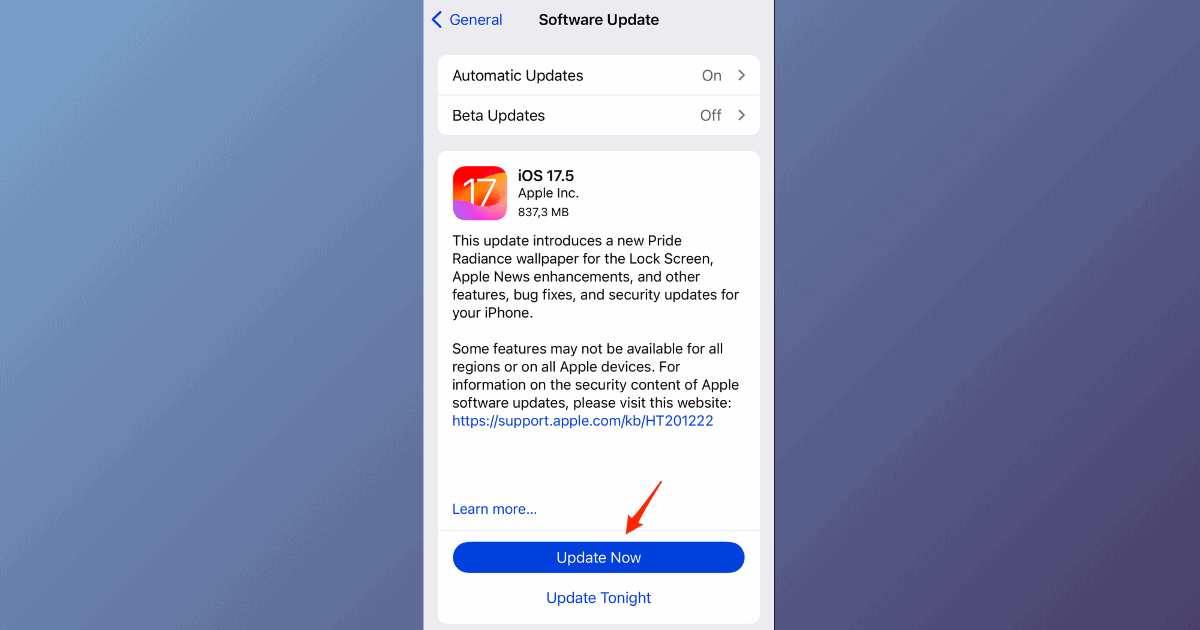

How To Install iOS 17.5 on Your iPhone

Explore our step-by-step guide on installing iOS 17.5. Check out the compatible devices and new features to ensure a smooth update.

Apple Vision Pro Finally Eyes Global Expansion 3+ Months After the US Launch

Apple’s pricey Vision Pro headset heads global after US sales slump. International launch & software update aim to reignite interest.

M4 OLED iPad Pro Has an HDR Bug, But Apple Promises Fix On The Way

A new report highlights a bug with HDR content, saying that certain shades of blue on OLED iPad Pro are causing colors to appear inaccurate.

Apple Releases iOS 17.5, iPadOS 17.5 & macOS Sonoma 14.5: Here's What's New

Apple today finally rolled out the much-anticipated iOS 17.5, iPadOS 17.5, and macOS Sonoma 14.5 for iPhones, iPads, and Macs.

Apple and Google Finally Team Up to Protect Users from Unwanted Tracking

Apple & Google team up! iPhones & Androids get new alert to warn of unwanted tracking by Bluetooth devices.

Apple’s Upcoming Native Ad-Blocker in Safari Worries UK Media Group

UK’s Media group has warned Apple that any such move to push native Ad Blocker in Safari would put their businesses (or journalism) at risk.

Less Than 0.1% of Developers Sign up for Apple’s New Payment System

Judge doubts Apple’s App Store payment changes address anti-trust concerns. Few developers use new system due to high fees.

You Can Now Play PS1 Games on iPhone with Gamma Emulator

Gamma is free to download on the App Store!

iPhone 16 Pro Will Reportedly Sport 20% Brighter Display

Apple’s upcoming iPhone 16 Pro could sport an upgraded display, according to a new rumor coming out of China.

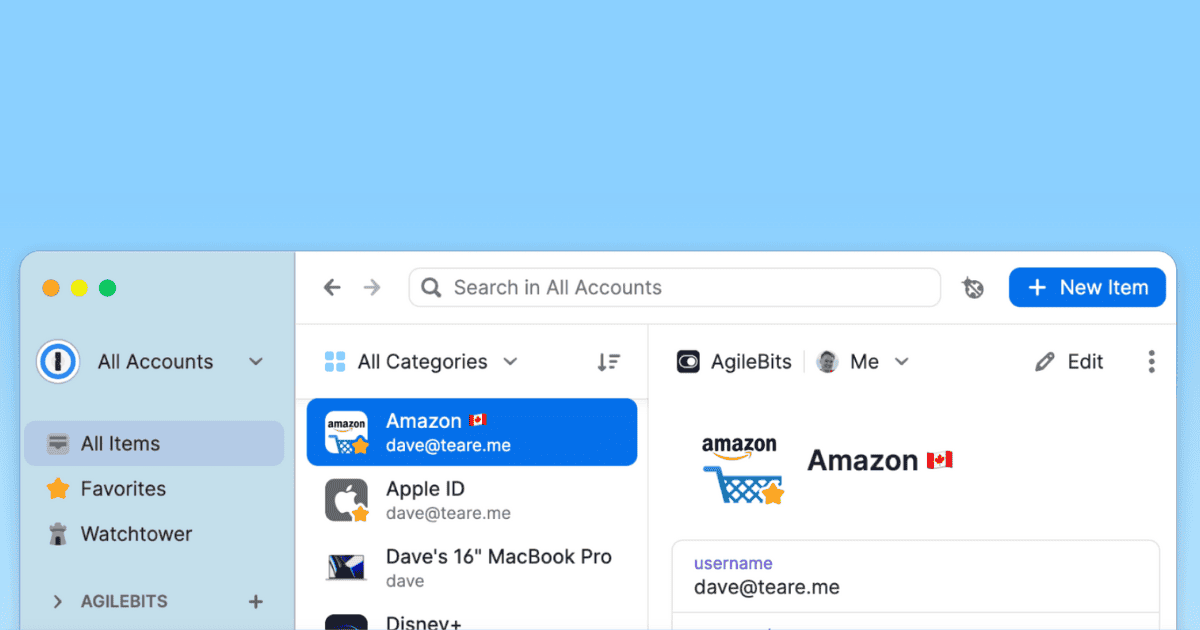

1Password for Mac Review: Is It the Best Password Manager?

Want to know how 1Password stores passwords and logins on your Mac? Read our hands-on review to learn all about this password manager.

10 Fun Games That You Can Play on a Mac Without a Mouse

Check out this list of the best Mac games you can play without using a mouse. Choose your favorite and get started now.

Apple Inches Closer to Bring ChatGPT-Powered Features to iPhone: Report

Apple is inching closer to closing a deal with OpenAI to leverage the popular AI chatbot, ChatGPT, for upcoming iPhone AI-focused features.

Is Apple News Worth It in 2024? A Quick Review

Is it worth paying a subscription to Apple News in 2024? Apple’s news aggregator has a lot to offer, though it may not be for everyone.

5 iPad Cases That Are Compatible With a Magic Keyboard

Are you looking for an iPad case that’s compatible with a Magic Keyboard? Check out our top options based on durability, value, and style.

Microsoft Announces Web-Based Xbox Games Store for iOS and Android

Microsoft is finally bringing its Xbox game store to iOS and Android this summer, confirming the previous reports.

Apple Mentioned 'AI' 8 times During 'Let Loose', and It's Not Just Talk

During the 38-minute-long keynote, Apple mentioned the term “AI” like eight times in several contexts. It seems like the Cupertino giant is bulling on AI after all.

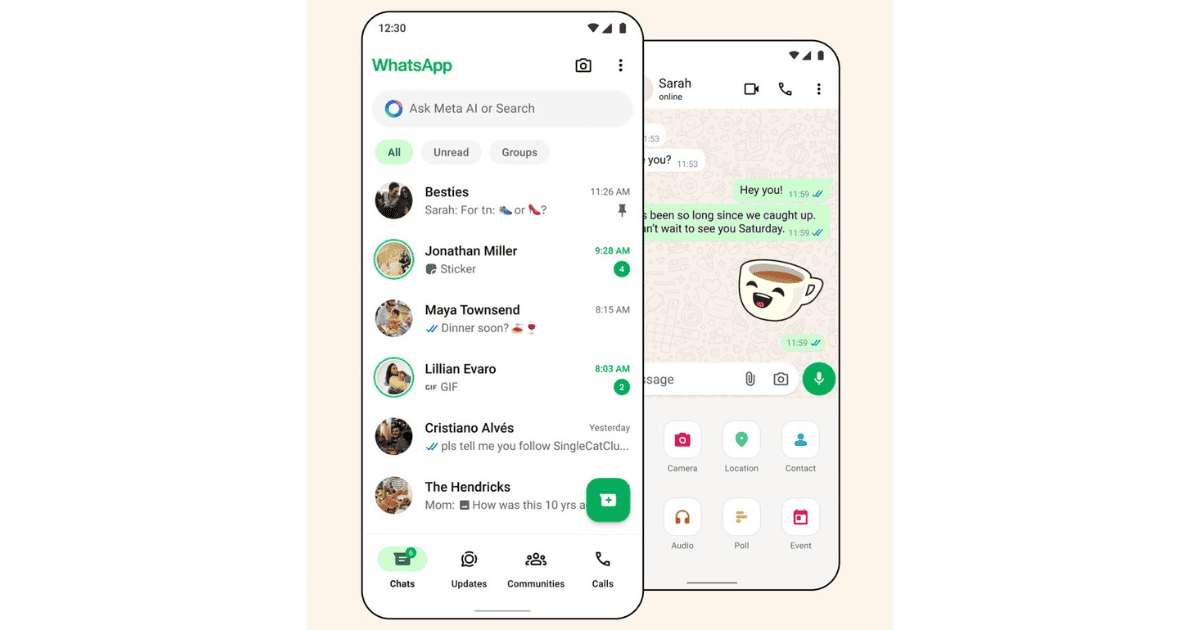

WhatsApp for iOS Gets a Major Design Overhaul

Latest WhatsApp update for iOS offers redesigned UI, new buttons, enhanced Dark Mode, and much more.