Apple will face an EU antitrust charge over its NFC chip and Apple Pay, which could result in a fine and changes to its mobile payment system.

Apple Pay

Unhappy Banks ask Visa to Eliminate Fees for Apple Pay Transactions

Big banks are reportedly unhappy with fees associated with Apple Pay transactions, and have asked Visa to eliminate them.

Researchers Hack Apple Pay to Steal Money With Visa

Apple claims that the problem lies with Visa’s network, while Visa says the payments are secure and “attacks of this type were impractical outside of a lab.”

New 'Mastercard Installments' Program Helps You Buy Now, Pay Later

A rumor we heard of in July was that Apple would launch “Apple Pay Later” to let people pay for purchases in installments, like Apple Card customers enjoy. This was not announced at the iPhone 13 event, but in the meantime, Mastercard customers can use a similar service.

Mastercard Installments enables consumers to digitally access BNPL offers, either pre-approved through their lender’s mobile banking app or through instant approval during checkout. Pre-approved installments can be used directly on a merchant’s website, and can be stored in digital wallets including Click-to-Pay, to then be used online or in-store wherever Mastercard is accepted. Instant approvals during checkout will be available through Click-to-Pay shortly after launch.

Another Apple Pay Patent Infringement Accusation

Patent lawsuits certainly keep Apple’s legal team busy. A Texas company has sued Cupertino over alleged Apple Pay patent infringement.

Challenges Ahead for Apple Pay Adoption

Looking at studies in consumer spending habits, we can see that there are clearly some hurdles still ahead for Apple Pay adoption.

Get Up to $30 Off Your Groceries with Instacart and Apple Pay

From now until September 8, 2021, US customers can get a hefty discount off their grocery order. The latest Apple Pay promotion gets new Instacart customers $30 off any order of $50 or more. Existing customers also benefit from the promotion with a smaller discount.Existing Instacart customers can get $5 off an order of $35 or more. If you subscribe to Apple Pay emails, you should have received a promotion code. If not, you will find a promotion banner to click at the top of the iOS Instacart app once you have Apple Pay enabled.

Support US National Parks by Using Apple Pay

The US National Park Service turns 104 on August 25, 2021. In honor of the occasion, Apple has announced a donation program, a new Apple Watch Activity Challenge, and special content collections to allow you to experience the parks and learn more about what makes them the amazing national resource that we often take for granted. From August 24 to August 27, Apple will make a $10 donation to the National Park Foundation for each purchase made with Apple Pay on its website, in the Apple Store app, or inside any Apple Store in the US. In years past, Cupertino’s offered much less of a donation per purchase, so this is pretty cool.

Our national parks strengthen our connection to nature, to one another, and to the soul of our nation. We’re excited to continue building on our four-year partnership with the National Park Foundation, and to support their work to preserve our parks for generations to come.

Tim Cook, Apple CEO

Get a Discount on a Subway Footlong With Apple Pay

We all like free stuff, but sometimes even just a few dollars off is still a great thing. Cupertino has offered discounts in the past to use its mobile digital wallet, and now has a new offer. Apple is offering a great discount on a Subway footlong. US customers who use Apple Pay with the Subway app can get a $2 discount off a footlong sandwich. All you have to do is install the Subway app on your iPhone or iPad, and order your sandwich in advance. If you use Apple Pay along with the promo code APPLEPAY, you’ll get two dollars off your order. This promotion only lasts until August 25, so take it advantage of it while you can. Define print states that the offer is only valid at participating subway locations in the United States, and extras, add-ons, and taxes are additional. You can’t use any other discounts or coupons with this offer, and Footlong PRO™ and Signature Wraps don’t count.

Apple Pay Dominated the Mobile Wallet Business in 2020

The most recent study of debit transactions in the US shows Apple Pay dominating the mobile wallet business more than twenty-fold.

Apple Pay Support Comes to Qatar

Believe it or not, some countries still don’t have Apple Pay support. We can now count Qatar as one of the countries that does offer support for Cupertino’s digital wallet, after a recent announcement by Qatar bank QNB.

QNB is one of the largest financial institutions in the region and operates a number of subsidiaries in 31 countries, including many neighboring states. While the company announced Apple Pay availability for all customers, it appears the service is currently limited to people living in Qatar.

“We are proud for taking the initiative of bringing Apple Pay to the Qatari market. QNB has a reputation of providing its customers with state-of-the-art technologies,” said Heba Al-Tamimi, general manager at QNB Group’s Retail Banking arm.

Mastercard Holders Can Now Use Apple Cash Instant Transfer

In an email sent to customers, Apple shared new updates related to Apple Cash, involving instant transfers.

Crypto Exchange ‘Coinbase’ Adds Support for Apple Pay

On Thursday Coinbase announced additional payment methods for buying cryptocurrency on its platform. For Apple users that means Apple Pay.

VPN Features, Apple Pay Mechanics – TMO Daily Observations 2021-08-03

Bryan Chaffin and Andrew Orr join host Kelly Guimont to discuss VPN features and how exactly Apple Pay simultaneously works and keeps you secure.

eBay Adds Support for Apple Pay on its Website

eBay has added support for Apple Pay on its website recently. Previously the payment option was only available in its apps.

Rumored ‘Apple Pay Later’ Would Introduce Installments for Purchases

A report on Tuesday claims that Apple is working on a feature called Apple Pay Later that would let people pay for purchases in installments.

Israeli Wallet Company Says Apple Pay Is Killing Physical Wallet Industry

Israeli wallet brand Emmanuel Wallets is boycotting digital wallets like Apple Pay, saying it’s harming the physical wallet industry.

Classic wallets have accompanied the human race for centuries and serve as a practical means of maintaining a means of payment and a fashionable accessory. A wallet is the type of item one holds, such as a phone… so it’s part of its unique style and personal branding. No technological gimmick, not even one promoted by the world’s largest tech company, will succeed in reducing the popularity of a physical wallet.

“No digital wallet will succeed in reducing the popularity of a physical wallet.” Well then, what’s all the fuss about?

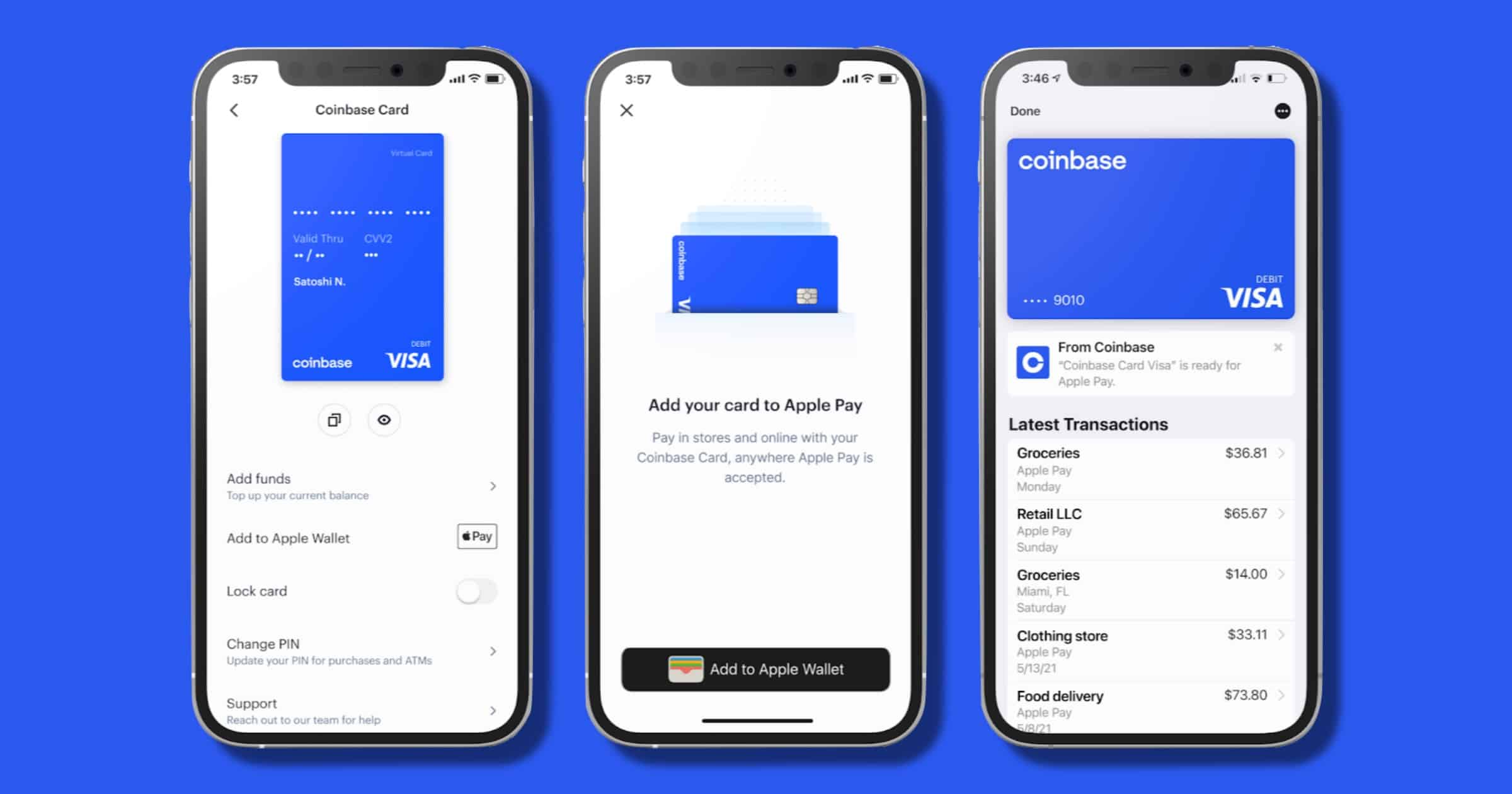

Coinbase Cards Can Now be Added to Apple Pay

People who have a Coinbase Card can add it to Apple Pay starting this week, the cryptocurrency exchange announced on Tuesday.

Apple Pay and Others Mean Banks Could be Squeezed Out, French Authorities Warn

Payment services from tech firms like Apple and Google risk squeezing out traditional banks and need monitoring. Authorities in France raised the concern that these firms can make money from these services but avoid much of the regulation, Bloomberg News reported.

The French authority also highlights access to near-field communication on smartphones used for contactless payment, an issue that has already triggered EU and Dutch antitrust probes and potential legislation to respond to banks’ complaints that Apple unfairly blocks their access on its devices. The companies that the French agency calls “les BigTech” are armed with “considerable financial power” to invest in new technologies and will have lower marginal costs compared to banks. Access to large volumes of data and processing power may allow them better assess customers financial health and offer them targeted services, the authority said. Integrating payments in other services allows them to offer a “customer journey” that can’t be matched or replaced easily by competitors, the authority said

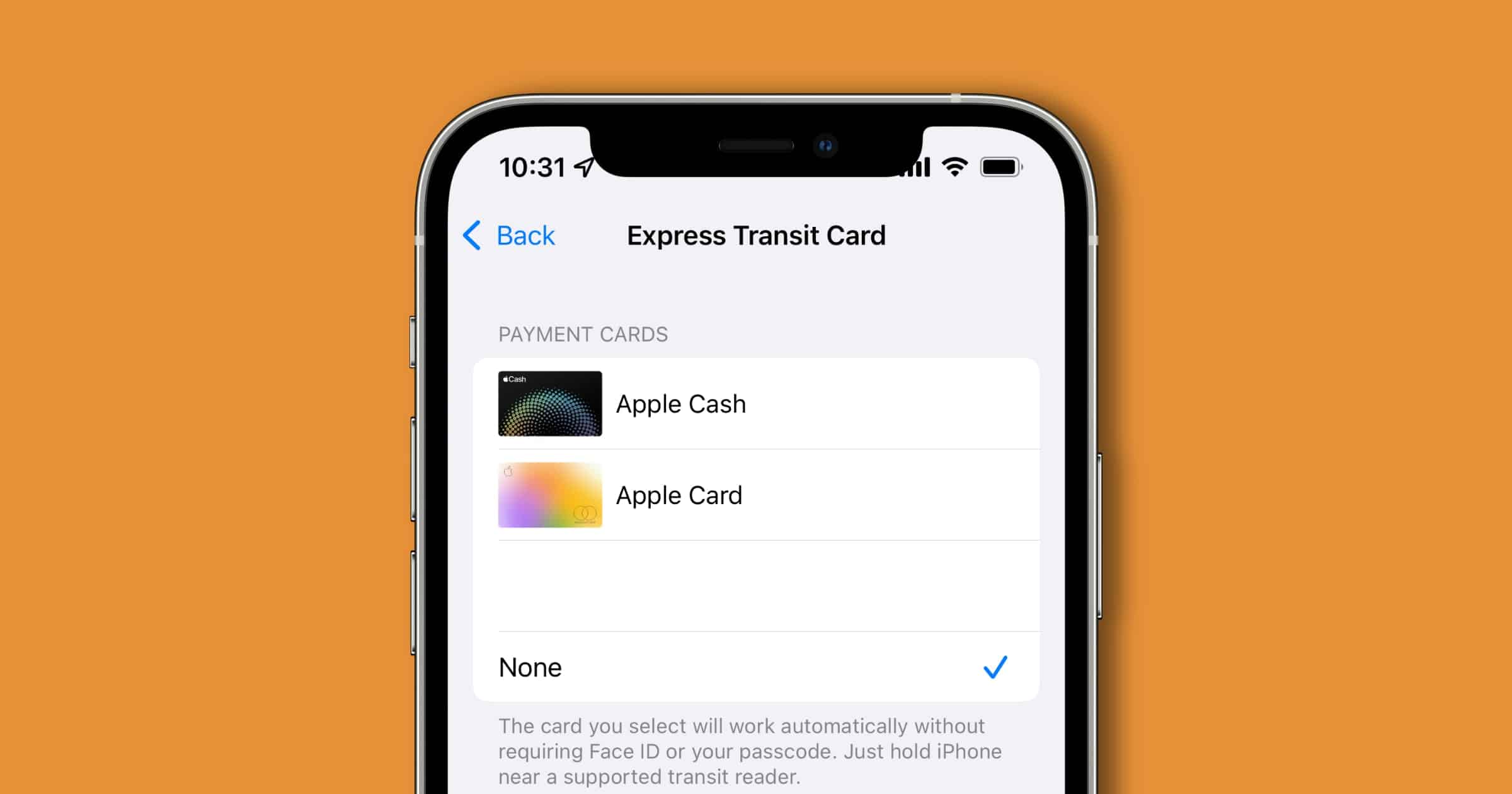

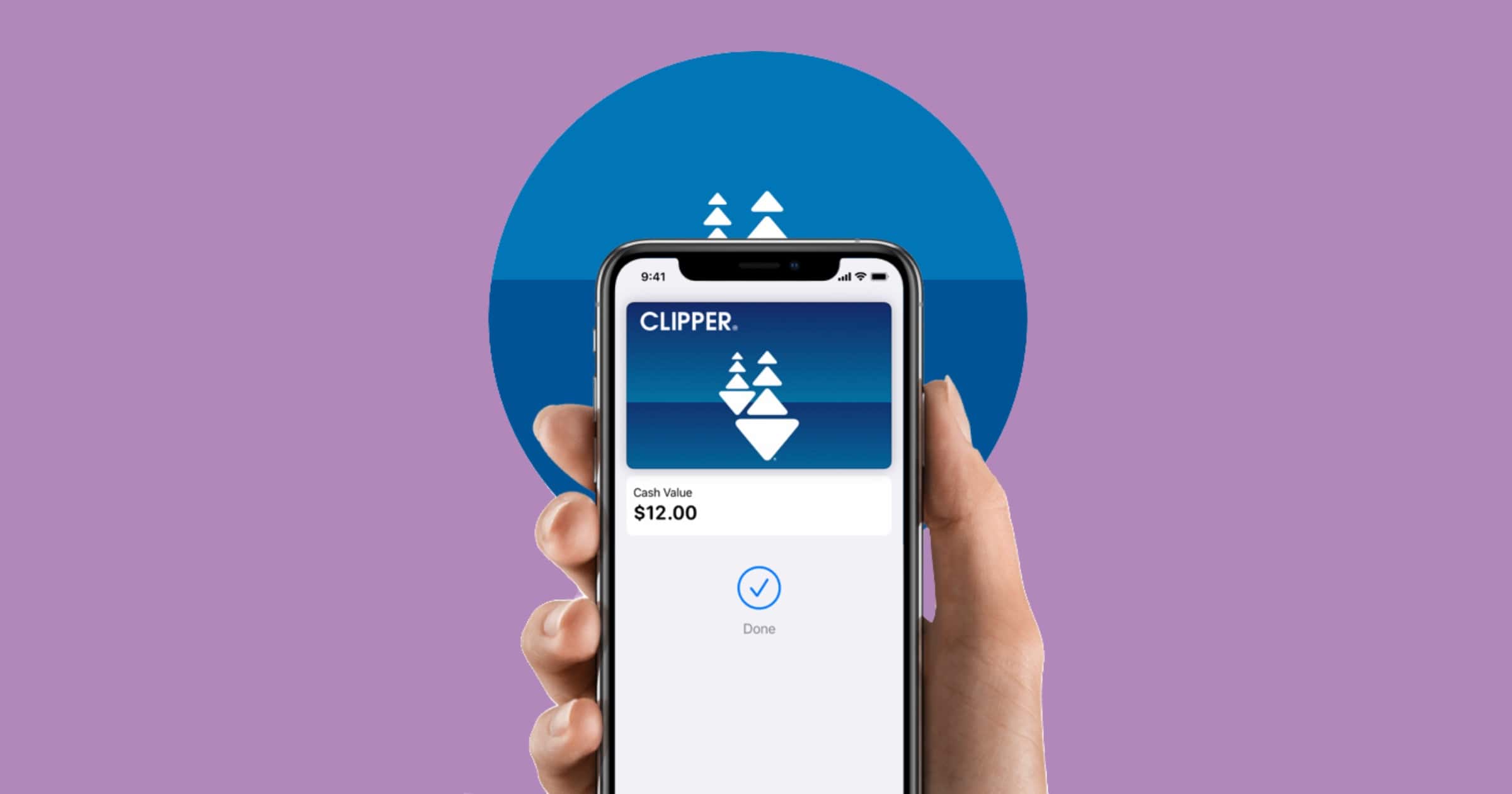

Clipper Card Now Works with Apple Pay For Easier Bay Area Transit

Those in the Bay Area can use Apple Pay when using any form of transit that is accessed with a Clipper card. The feature now works on BART, Muni, Caltrain, and the ferryTechCrunch reported.

As noted back in February when this was first confirmed as on the way, Clipper works with Apple’s “Express Transit” feature. That’s just a fancy way to say that you can tap to pay with the digital Clipper card without first needing to punch in your phone’s PIN or using FaceID. On certain newer iPhones, it also lets you keep using the Clipper card for a few hours after your battery has died; a wonderful thing in a pinch, but probably not something you want to rely on regularly.

Celebrate Earth Day 2021 by Using Apple Pay

Now through April 22 Apple will donate US$1 to Conservation International for every Apple Pay transaction made with Apple.

QuickTrip Rolls out Support for Apple Pay at Gas Pumps

A report on Monday shows that QuikTrip is rolling out support for Apple Pay at its gas pumps.

Apple Pay Launches in South Africa for Contactless Payments

Contactless payment service Apple Pay has launched in South Africa, joining Samsung Pay which launched in the country in 2018.

The UK Contactless Payment Limit Has Gone up, But it Will Have Little Impact on Apple Pay

The UK limit on single contactless transactions – those that you can simply tap your card to make, no pin or signature required – has increased to £100. However, as Ben Lovejoy at 9to5 Mac noted, this will have little impact on those who want to use Apple Pay to purchase goods as the limit was already significantly higher than that. (In the U.S. of course, the situation is different with different ceilings on when a signature etc is required.)

Apple Pay uses a more sophisticated form of contactless payment reserved for mobile wallet devices that have biometric authentication. With this protocol, banks and retailers can set a much higher payment limit, or even have no limit at all, because the device verifies the identity of the user via Face ID or Touch ID in the case of an iPhone, or the PIN you entered on an Apple Watch when putting it on in the morning. When I asked at the time of launch, my bank hinted that its own limit was £750 ($1,050), and certainly I have made three-figure purchases using Apple Pay. Some people report successfully using Apple Pay for mid-four-figure purchases.