Stuck on “There is a billing problem with a previous purchase?” Learn why it happens and get quick fixes for MacBook, iPhone, and Apple TV.

Apple Pay

How To Add Your Apple Account Card to Wallet on iPhone

Explore how to add and use the Apple Account Card in your iPhone Wallet for seamless purchases, and its advantages over iTunes Pass.

Apple Makes Tap to Pay on iPhone Available for UK Merchants

Apple today announced the availability of Tap to Pay on iPhone in the U.K., allowing merchants to use an iPhone as a payment acceptance method.

Anticipating WWDC 2023 - TMO Daily Observations 2023-03-30

Apple has announced dates and details for WWDC 2023. TMO Managing Editor Jeff Butts joins Ken to talk over the remoteness of the conference and what the world can expect. Plus – Glitches with Apple Pay and (maybe) Apple Podcasts. AND – Ken and Jeff give first impressions of Apple Music Classical.

Siri, Savants and What's the Opposite of a Swan Song?

Apple Pay Later starts its slow roll, the OS beta train is already moving again, and the curtain is finally up on Apple Music Classical.

Announcements Inside the Yellow iPhone Announcement - TMO Daily Observations 2023-03-08

As had been rumored, Apple’s announced big yellow additions to the iPhone 14 line. TMO Managing Editor Jeff Butts and Ken talk over the Emergency SOS and Apple Pay announcements inside that announcement. Plus – Stay at the pub where Ted Lasso hangs out!

Where iPhones Are Sold and Some Christmas Carols - TMO Daily Observations 2022-12-13

CIRP says where iPhones are sold in the states may be a weak point for Apple. TMO Managing Editor Jeff Butts and Ken discuss that. Plus – talking over SNL’s very bloody parody of “A Christmas Carol” and Apple Pay.

Violent 'Saturday Night Live' Sketch Comically Promotes Apple Pay

A “Saturday Night Live” sketch featuring Martin Short and Steve Martin pokes fun at “A Christmas Carol” while promoting Apple Pay.

New Holiday Savings Promotion Arrives to Apple Pay

A new holiday promotion for Apple Pay can find customers receiving various discounts and offers for several online retailers.

Supply Chain Chatter and Union/Disunion

Pronouncements on iPhone production, two tales of Apple and retail worker unions, and more on Apple’s advertising pause on Twitter.

Regulators' Probe Continues Delay of Apple Pay Launch in South Korea

The Apple Pay launch in South Korea has been pushed back in late December due to further probes by financial regulators.

Goldman-Sachs Updates Customer Agreement for Apple Card Daily Cash Savings Account Feature

Reports indicate that Goldman Sachs has updated the customer service agreement concerning the new savings accounts for Apple Card owners.

Apple Pay to Launch in South Korea November 30

An ad spotted in a local taxi hints that Apple Pay could launch in South Korea as early as … well … tomorrow.

Apple Pay in South Korea Gets Mixed Reactions Ahead of Launch

Ahead of its launch by the end of November, Apple Pay has been receiving mixed reactions from the country’s mobile payment market.

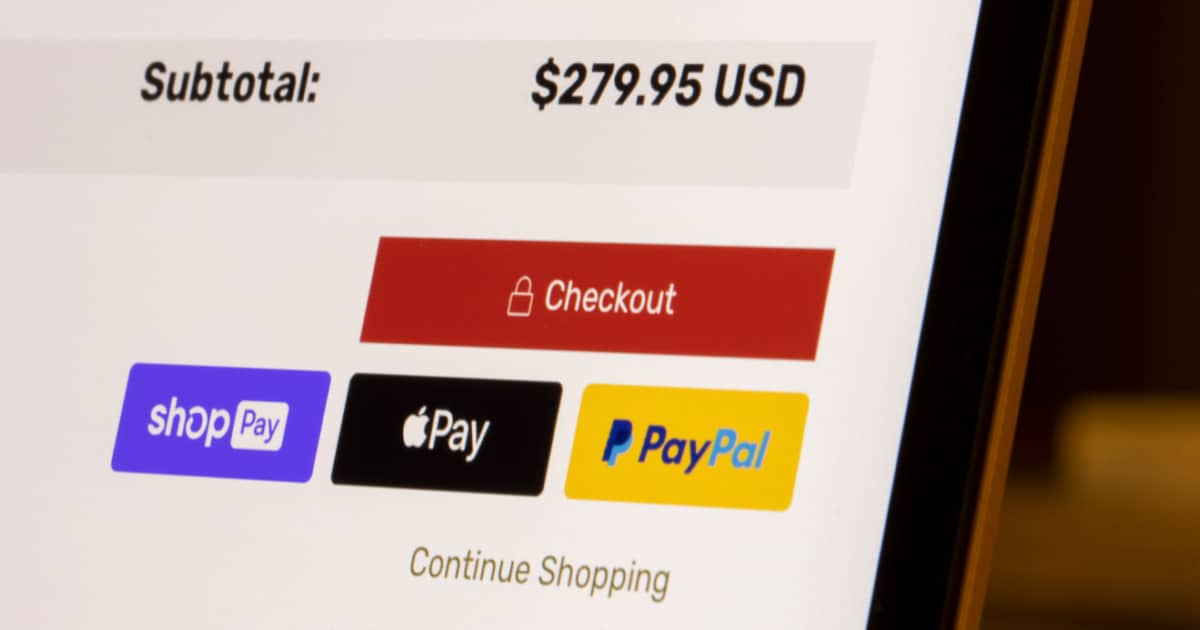

Apple and PayPal Start Playing Nice, Adding Tap to Pay and Wallet Support

Fintech giant PayPal recently announced upcoming support for the Apple Tap to Pay feature, as well as Apple Wallet integration.

Apple Pay Later Service May Come Later, in Spring 2023

One feature promised during the WWDC announcement of iOS 16, Apple Pay Later, might not arrive until much later than originally expected.

Apple's Wallet App Seems Deletable as Suggested by Code Found in iPadOS 16.1

Apple’s Wallet app may soon be deletable from an iPhone and downloaded again from the App Store, as hinted at by code in iPadOS 16.1.

Apple Celebrates America's National Parks Through Apple Pay Donations, Apple Watch Challenge and More

Apple is celebrating America’s national parks by donations through purchases as well as ways users can learn more about the parks.

Apple Pay Now Available in Malaysia in Partnership in MayBank, AmBank and Standard Chartered Bank

Apple Pay is now available in Malaysia in partnership with 3 banks, namely Maybank, AmBank and Standard Chartered Bank.

Apple Pay Works on Third-Party Browsers in iOS 16 Beta 4

Apple seems to have enabled Apple Pay in third-party browsers like Chrome, Edge and Firefox under iOS 16 beta releases but not in macOS beta.

New Apple Pay Ad Campaign Highlights Security and Ease Over Credit Cards

Today Apple has released an ad campaign for Apple Pay. The three short videos are available on Apple’s U.K. YouTube channel.

Apple Gets Another Antitrust Lawsuit, This Time For Charging Apple Pay Fees to Card Issuers

Hagens Berman has filed a lawsuit accusing Apple of antitrust violations for charging card issuers Apple Pay fees on every transaction.

Adyen Rolls Out Tap to Pay on iPhone with More Business Partners

Global financial technology platform Adyen has rolled out Tap to Pay on iPhone with its business partners to enable contactless payments.

Belgian Bank Belfius Confirms Upcoming Apple Pay Support for Bancontact Cards

Belgian bank Belfius has recently confirmed it will soon offer Apple Pay support to its Bancontact cardholders.